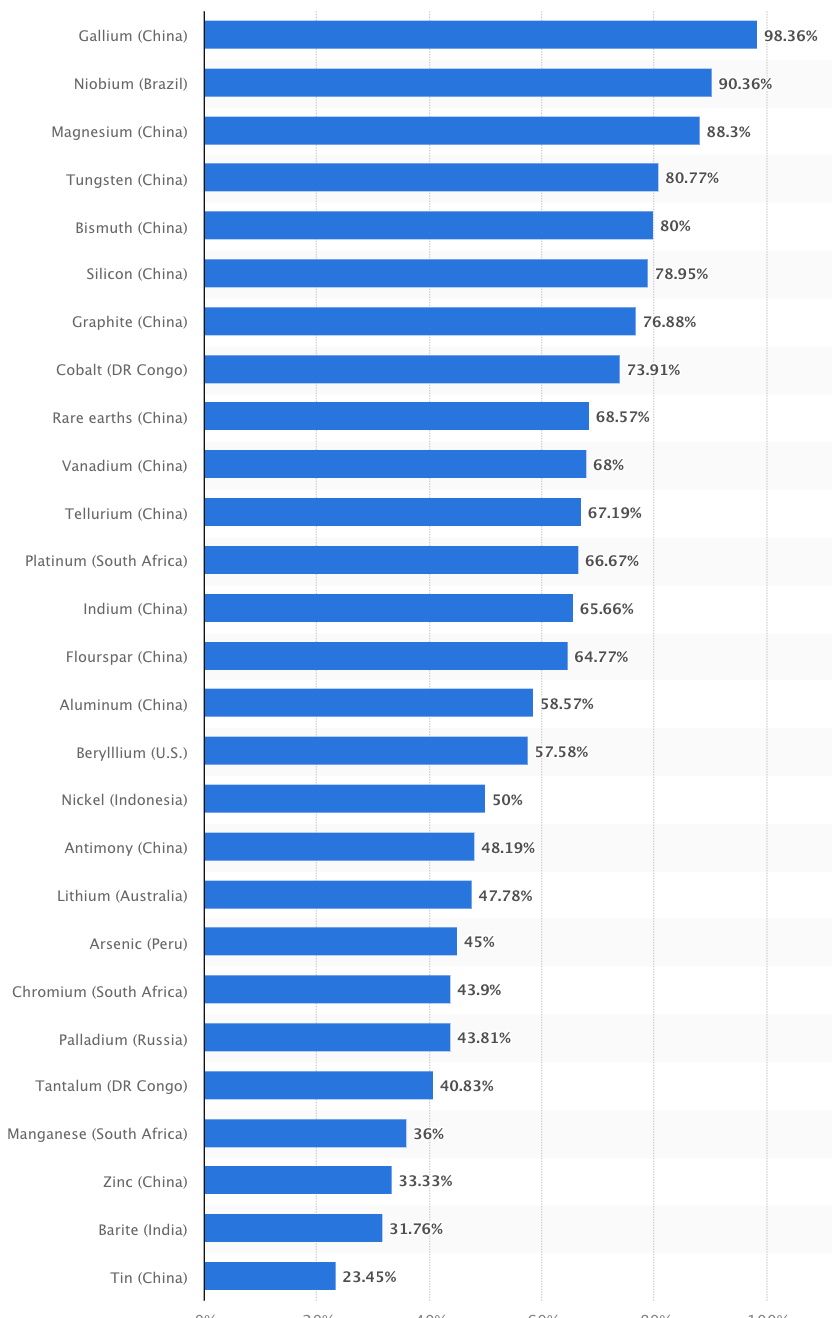

There are 27 critical minerals essential for economic production. For how many does China account for more than half of world production?

2

3

5

9

15

And the answer is …

As the Statista chart below shows, the answer is 15. The U.S. number is 1. For 6 of the minerals, China’s share exceeds 75 percent.

What fraction of the world’s population will live in cities in 2050?

a. 20 percent

b. 45 percent

c. 60 percent

d. 70 percent

e. 85 percent

And the answer is …

The answer is 70 percent — up from 56 percent today. A remarkable 80 percent of world GDP is currently produced in urban areas.

What fraction of the U.S. population considers itself multiracial?

b. 5 percent

d. 10 percent

e. 15 percent

f. 20 percent

And the answer is …

The answer is 10 percent.

How many soldiers fought for the Soviet Union during WWII?

a. 7 million

b. 17 million

c. 27 million

d. 34 million

e. 41 million

The answer is …

The answer is 34 millon. The Soviet Union’s population in 1940 was 186 million. Russia’s current population is 144 million. Based on its WWII conscription rate, Russia should be able to field a 26 million-person army. It currently has roughly 1.5 million soldiers. This suggests it has the potential to throw far more personnel into its war with Ukraine, where it has already suffered an estimated 600,000 casualties. This is closing in on the total number of Civil War casualties.

How many armed conflicts are there currently underway across the globe?

a. 7

b. 39

c. 71

d. 114

e. 291

f. 311

And the answer is …

The answer is 114. The Middle East and North Africa have 45 conflicts going. Africa has 35. Asia has 21. Europe has 7. And Latin America has 6.

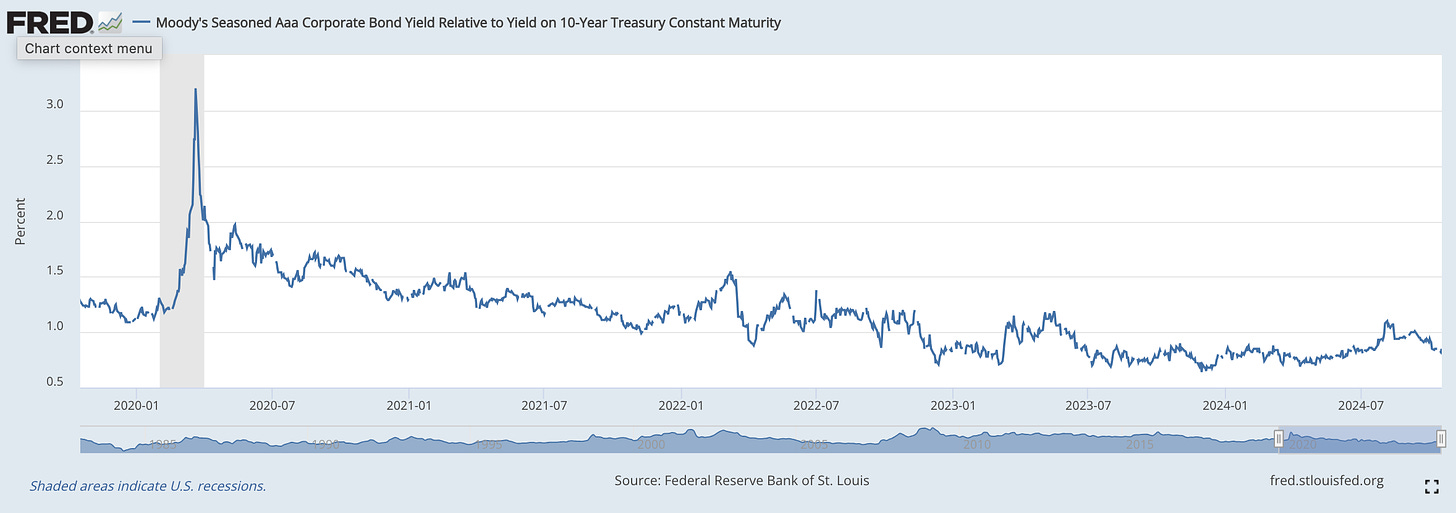

Is the current difference between yields on Aaa long-term corporate bonds and 10-Year Treasuries currently?

a. Very high

b. Typical

c. Very low

And the answer is …

The answer is super low. As this St. Louis Federal Reserve Bank chart shows, the ratio of the 20-year corporate yield to the Treasury bond yield is now at a quarter-century low. This may reflect 1) predictions that inflation will be lower in the long term compared with the medium term, 2) concern about default on U.S. Treasuries due to an historic high (for peacetime) ratio of federal debt to GDP and CBO forecasts that federal debt will continue to rise dramatically relative to GDP, 3) perceptions that the U.S. corporate sector is less risky long term than previously believe. I haven’t studied all the related evidence, so this is simply off the top of my head. As you can see at zvibodie.com, the real yield on 30-year TIPS remains above 2 percent — which is close to a 15-year high. This suggests a reduction in the risk premium — the extra return investors demand for buying stocks and other securities. I.e., it signals less concern about the economy’s future performance. But it may also mean that Treasuries are viewed as riskier than they were in the past compared with corporates and other investments.

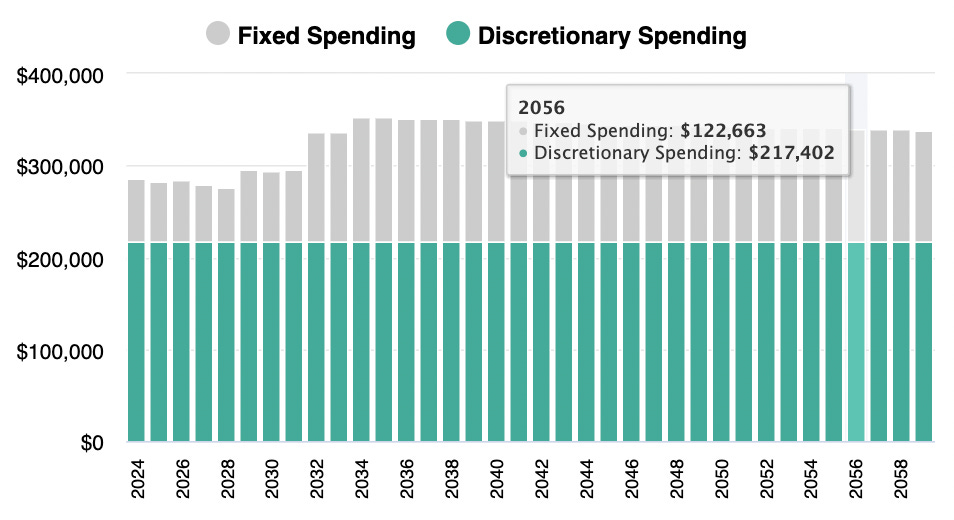

Frank, retired, is age 65 and has just enrolled in Medicare. He has $3 million in regular assets and $3 million in an IRA. He’s invested all his assets in long-term TIPS that yield 2 percent above inflation. Frank lives in Tennessee, which has no state income tax, and rents an apartment for $3,000 per month, which he expects will keep even with inflation. Finally, when Frank turns 70, he’ll start receiving $57,000 in Social Security benefits valued in today’s dollars. Frank will also receive a $45,000 nominal pension starting when he turns 70. Frank’s maximum age of life is 100. Apart from paying rent and taxes, how much can Frank spend annually, in today’s dollars, year in and year out, through age 100? I.e., what is Frank’s real (inflation-adjusted) sustainable discretionary spending?

a. $55,210

b. $91,216

c. $134,431

d. $180,356

e. $217,402

f. $255,739

And the answer is …

The answer, as calculated by MaxiFi Planner, is $217,402. Here’s a chart showing, in green, Frank’s highest sustainable discretionary spending.

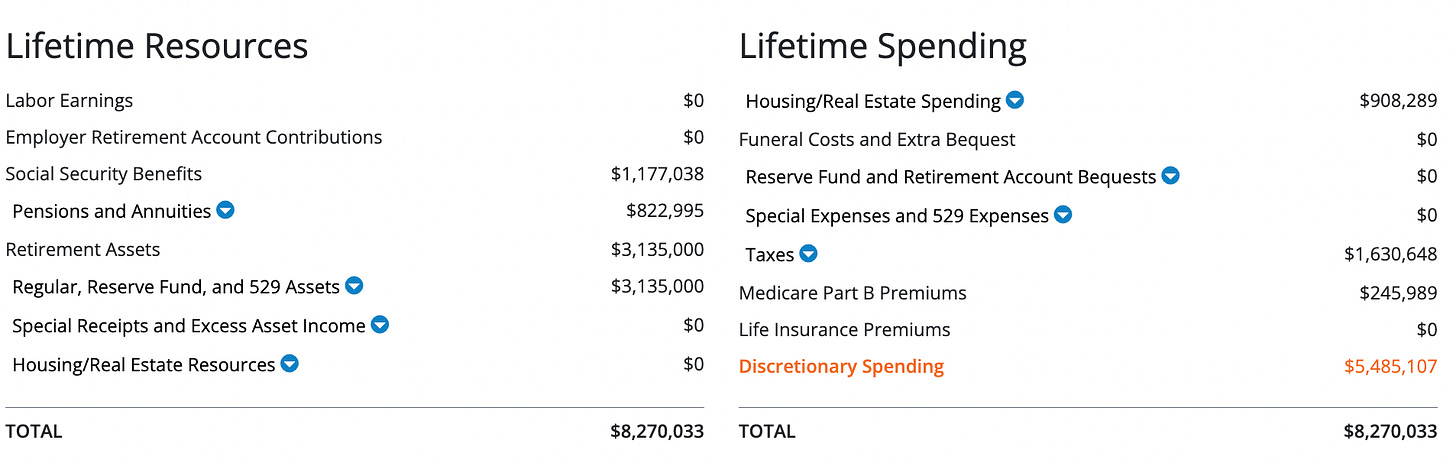

Fixed spending in the chart references Frank’s rental costs, his annual federal taxes, and his Medicare Part B IRMAA premiums. MaxiFi took less than one second to produce this result. My guess is that most of you missed the mark by $30,000 or more. I was off — too high — by over $40K. Note that the path of Frank’s taxes and Part B premiums are consistent with his path of spending and vice versa. Indeed, the two paths are simultaneously calculated using MaxiFi’s patent-winning iterative dynamic programming algorithm. But how does Frank know MaxiFi’s calculation is correct? Easy. First, he can see with his eyes that his discretionary spending is smooth — precisely the same amount annually. Second, he can check that his lifetime budget is precisely satisfied, i.e., as the chart below shows, the present value of his resources precisely equals the present value of his outlays. Third, he can check each year’s tax calculations. (MaxiFi lets you see all the details of its annual derivation of taxes.) Fourth, Frank can see from tracing MaxiFi’s display of his annual regular assets that he dies broke. (I didn’t specify a terminal bequest, or gifts, or funeral expenses. Had I done so, he’d die broke after his estate covered those outlays.)

What’s the chance that you are spending and saving anywhere near the right amounts — the amounts MaxiFi would tell you to spend and save given your financial circumstances, demographics, and preferences concerning the path of your living standard.

a. 50 percent of more

b. 25 to 50 percent

c. 1 to 25 percent

d. Zero

And the answer is …

The answer is zero. Financial planning is either precisely right or precisely wrong. MaxiFi makes extraordinarily complex, detailed, interactive calculations under its hood to form financial plans that are precisely right. It’s code for Social Security alone runs over a full ream of computer paper. Unless you are using MaxiFi or your advisor is doing so on your behalf, you are surely making major financial mistakes. Having invented MaxiFi’s algorithm, I can’t begin to figure out its answers with any accuracy. The problems MaxiFi jointly and instantly solves are just too complex for my or anyone else’s brain. But prove me wrong. Try MaxiFi. If you find you are saving within 10 percent of what MaxiFi suggests you spend and doing the same with respect to life insurance, email me at kotlikoff@gmail.com and I’ll refund your purchase and provide you the year’s license for free.

How much can Frank save in lifetime taxes\raise in lifetime discretionary spending by running MaxiFi’s Robo Roth Converter tool, which robo-optimizes Frank’s Roth conversion problem. I.e., it determines how much Frank should convert annually to reduce his lifetime taxes as much as possible.

a. $13,219

b. $28,911

c) $39,991

d) $91,435

e) $331,167

And the answer is …

The answer is $331,167. I’ll be discussing this and other robo MaxiFi Roth converter findings in a future newsletter. In the meantime, if you want to formulate a conversion plan, run MaxiFi, and run the Maximization Report, where you can tell the program to maximize the gains from Roth conversion.

Hi Jerry, Here's the story. I too was surprised, but Europe is a big place. Cheers, Larry

The following military occupations constitute the majority of armed conflicts that are taking place in Europe, four out of seven conflicts: Russia is currently occupying Crimea (Ukraine), Transdniestria (Moldova), as well as South Ossetia and Abkhazia (Georgia), while Armenia is occupying parts of Nagorno Karabakh (Azerbaijan). Europe is also the theatre of an international armed conflict (IAC) between Ukraine and Russia, and of two non-international armed conflicts (NIACs) in Ukraine opposing governmental forces with the self-proclaimed ‘People’s Republics’ of Donetsk and Luhansk in eastern Ukraine.

I am a bit skeptical about the number of armed conflicts you site. Can you specify the ones in Europe, for example? I don't doubt the number in the Middle East and Africa (could be more?) although exactly what they are isn't clear without delving into them.