Eight House Republicans, led by Florida Congressman, Matt Gaetz, just vacated their leader, Kevin McCarthy. This was no minor coup. It’s the first time a House Speaker has been given the boot.

Why did the Gang of Eight fire McCarthy?

Maybe they don’t like him? Maybe they want his job? Maybe they seek better committee assignments? Maybe they are anarchists? Maybe they are Putin’s agents?

Whatever the real reason, the stated reason was to keep McCarthy from enabling Joe Biden’s supposedly unprecedented fiscal profligacy, particularly continuing to help Ukraine defend itself from Vladimir Putin’s invasion and genocide. Putin’s latest genocidal act is yesterday’s missile attack on a Ukrainian funeral, which killed 51.

But, no matter. Helping Ukrainians defend us as well as themselves is just too expensive. How do Putin Republicans reach this moral judgement? Easy. They have God on their side. What’s not on their side are the economic facts.

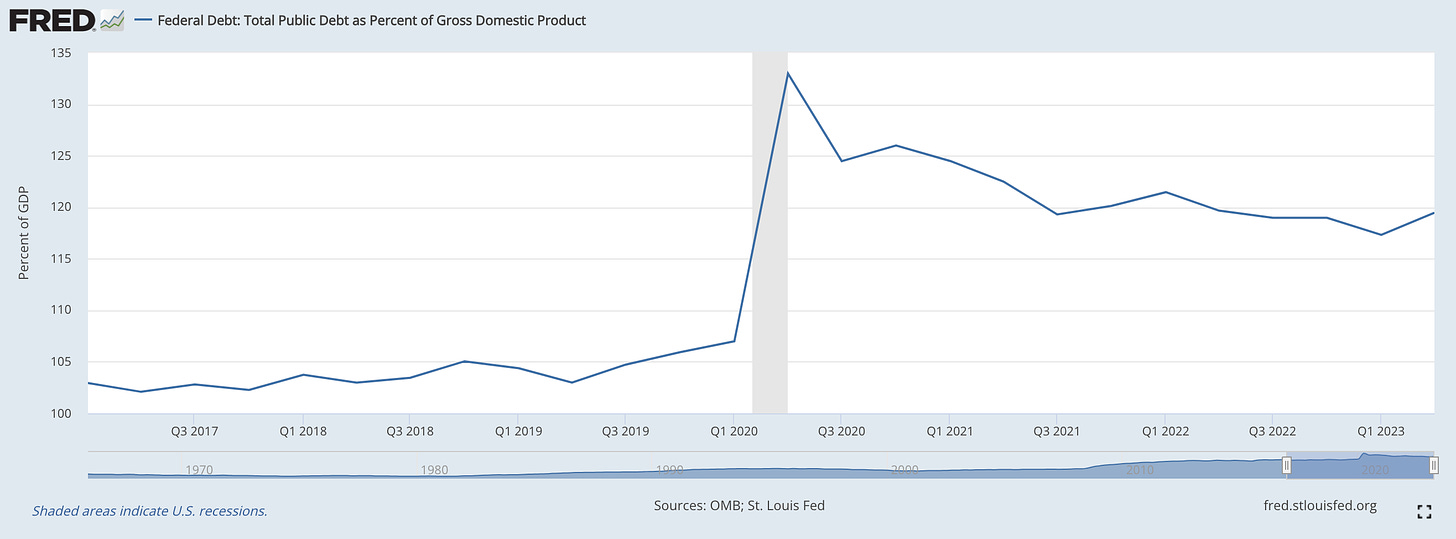

The true story about official debt is conveyed in the chart below, which comes courtesy of the Federal Reserve Bank of St. Louis (FRED). It graphs gross federal debt as a share of GDP starting in the first quarter of 2017, when President Trump took office.

After Adjusting for Economic Growth and Inflation, “Biden Is Running Surpluses”

Here’s what you won’t hear from Matt Gaetz: Federal Debt as a share of GDP has declined -- from 125 percent to 119 percent – since President Biden took office. Yes, official gross federal debt has been growing rapidly. It’s now $33 trillion. That’s massive. But our economy’s $28 trillion GDP is also massive. And since Biden was elected President, US GDP has grown faster than official debt.

Part of the story involves real growth. Our real economy has been expanding significantly thanks to the ongoing post-COVID rebound in labor force participation. But inflation has played the biggest role. It’s raised the nominal value of GDP without, obviously, increasing the size of outstanding debt. Such watering down of official debt via inflation is nothing new. For example, between 1946 and 1948, inflation wiped our roughly a quarter of the real value of Uncle Sam’s World War II debt. In any case,

After adjusting for nominal growth in GDP, which every economist, but few lawyers, realize is essential, President Biden has been and is currently running huge surpluses, not big deficits!

“President Trump Was Also Fiscally Conservative” Until Covid

As the chart shows, official debt stayed roughly constant relative to GDP under President Trump. That’s before COVID struck. Then the debt-to-GDP ratio shot up dramatically. It did so for two reasons. First, the Trump Administration raised the debt-to-GDP’s ratio’s numerator. It did so by spending lots of money keeping businesses from collapsing and preventing millions of people from starving. Second, the ratio’s denominator, GDP, fell precipitously before recovering.

Could the Payment Protection Plan and other COVID programs have cost far less and been far better targeted? Absolutely. But the Trump Administration deserves enormous credit for rescuing the economy not to mention delivering life-saving vaccines at warp speed. Moreover, between 2020 and 2021, i.e., under Trump, debt fell from 133 percent of GDP to 125 percent.

Thus, since 2020, the debt-to-GDP ratio has dropped by 14 percentage points! This makes the last four years the most fiscally conservative in decades!

Now, For the Rest of the Story — Fiscal Policy Operates On Its Own, Short-Term, and Very Slowly, Long-Term

What Matt Gaetz knows, but isn’t saying, is that three quarters of federal spending is mandatory, comprising outlays on Social Security, Medicare, Medicaid, and Veteran Benefits. No President, no member of Congress, and no political party has control over this spending. It’s on autopilot. The only way to change the path of mandatory spending is via fundamental entitlement-policy reform. Therein lies our nation’s existential fiscal rub. Changing these programs in fundamental ways is, at least with our current politicians, politically impossible. But maintaining these policies in place with no ability to limit their outlays spells financial suicide.

Yes, Matt Gaetz has mentioned entitlements. He’s even suggested making young people wait longer to collect full Social Security benefits. But raising Social Security’s full retirement age will make hardly a dent in the system’s $65.9 trillion unfunded liability. Funny that Congressman Gaetz has failed to publicly mention that figure, which is twice the size of official debt.

Our all-too-real entitlement debt is growing, not falling, as a share of GDP. Faster-than-GDP growth in the four mandatory programs, not discretionary spending, over which Congress has full control, but which is far too small to matter, is why the Congressional Budget Office projects a doubling in official debt relative to GDP by 2053.

Are Presidents Actually Responsible for Increases or Declines in the Debt-to-GDP Ratio?

If federal spending is largely out of the politicians’ control – if it’s mainly either on autopilot or a response to emergencies, like COVID and Putin’s invasion and if inflation is largely out of the Federal Reserve’s control, which is also true — then we can’t credit Presidents for increases or decreases in the debt-to-GDP ratio during their terms in office. That’s why the headings above, referencing Presidents Biden and Trump being fiscally conservative, are in quotes.

Indeed, the main reason the debt ratio rises, falls, or stays constant in the short term is not due to new policies that alter the course of the ratio’s numerator. The main reason is changes in the ratio’s denominator. If nominal GDP rises fast enough, thanks to real growth or inflation, the ratio will fall or stay constant. Otherwise, it will rise. And, sorry Matt, the private sector, not our President, determines what happens to our country’s real GDP over the length of an administration. As for inflation, 35 million American businesses set a far larger number of prices and do so in light of foreign competition, i.e., decisions by hundreds of millions of foreign companies. The Fed Chair controls one price — the short-term price of money. This is why the Fed can wish inflation away, but can’t drive it away, at least absent a draconian measure — coordinating a major recession.

Yes, big policy changes, like the establishment of Medicare, can matter to the debt-to-GDP ratio. But the impacts of such policies occur over decades, not years. How do I know? I helped pioneer dynamic modeling of the economy. Together with co-authors, I’ve run all manor of policy simulations — tax cuts, changes in discretionary spending, Social Security reforms, adoption of alternative tax systems, carbon taxation, increasing tax progressivity, you name it. None of the policies do much of anything to debt-to-GDP ratios within four years even though all can make huge differences over three and more decades.

Moderate Republicans Must Come to the Aid of their Country

Not all House Republicans are shilling for Donald Trump who is, as ever, shilling for Vladimir Putin. There are some 70 out of 221 House Republicans who are self-described moderates. Any six of them can join with House Democrats to elect a moderate Republican as House Speaker and pursue responsible legislation, including funding Ukraine. Let’s hope they do so even if it puts them in political jeopardy. They came to Washington to secure the nation’s future, not their own. That future includes their children’s, who are fundamentally no different from the eight year-old boy Putin killed yesterday in his missile strike or the scores of children he will kill in the next few days in his effort to wipe Ukraine and Ukrainians from the face of the earth.

____________________________________________________________________________

These links may be of interest:

Hi Scott, Pls reread. I said the opposite. I also said the bounce back started in Trump's last year. And I said that no president controls these ratios. You skimmed. Because you are repeating back what I wrote. Pls reread. best, Larry

Hi Paul, Which speaker was remove in the past? And yes, we are doing linguistic-based accounting and missing the overall picture of our country's long-term fiscal insolvency. best, Larry