Happy New Year to my rapidly growing readers of Economics Matters — the Newsletter, Economics Matters — the Financial Riddler, and Economics Matters —the Podcast. I wish you and yours great health, prosperity, and a ton of fun in 2024.

Did slavery cause the Civil War?

a. Yes

b. No

And the answer is …

The answer is yes.

Was 2023 the warmest year on record?

a. Yes

b. No

And the answer is …

The answer is yes.

To quote ABC news, “NOAA, Copernicus, the the U.N. and the World Meteorological Organization all released reports recently that said 2023 has been the warmest year on record.” The climate isn’t changing decades from now. It’s changing now. Last year, 12 hurricanes in the Atlantic and Pacific experienced rapid wind intensification. That’s when a CAT 2 hurricane become a CAT 5 (157 MPH wind speed) hurricane in a matter of days, if not hours. Hurricane Lee picked up 85 MPH in the course of 24 hours. Fortunately, it lost speed before hitting Florida. Can a typical 30-year-old wooden house on a concrete slab withstand a CAT 5 storm? No. Plenty of folks in our country don’t believe the climate is changing. Maybe perceptions are changing. Louisiana experienced record draught and a terrible fire season that produced ‘super fog’ in New Orleans. Phoenix experienced a month straight of temperatures at or above 110 degrees. I could go on, but I need to get to my next question, here in New England, where people are doing snow dances.

With an almost 20 percent national office vacancy rate (It’s a record 35 percent in San Francisco!), new office construction starts are down compared to last year. By what percentage?

a. 2 percent

b. 5 percent

c. 17 percent

d. 31 percent

e. 40 percent

And the answer is …

The answer is 40 percent. That’s a ten-year low.

How many banks would essential go broke were they to face a 10 percent losses in the value of their commercial real estate assets, including holdings of loans on commercial real estate?

a. 5 percent

b. 15 percent

c. 25 percent

d. 35 percent

e. 45 percent

f. 55 percent

And the answer is …

The answer is 55 percent. With a 30 percent loss, 80 percent of banks would be underwater. This is based on a Federal Reserve study. The authors don’t refer to banks going broke. They refer to banks exhausting their capital buffers. This is code for a bank’s landing in a position where losing another penny leaves its assets worth less than its liabilities. We already have many zombie banks — banks in the red when marked to market. They are surviving because their depositors don’t believe other depositors, particularly uninsured depositors, will do what uninsured depositors did last spring to Silicon Valley Bank and several other largish banks, namely run (click a few buttons on their cell phones) for their money.

How much did the S&P rise this year?

a. It fell.

b. 4 percent

c. 9 percent

d. 15 percent

e. 24 percent

f. 32 percent

And the answer is …

The answer is 24 percent. The NASDAQ did even better — 43 percent! To quote ABC News, The broader market's gains were driven largely by the so-called Magnificent 7 companies, which include Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms and Tesla. They accounted for about two-thirds of the gains in the S&P 500 this year, according to S&P Dow Jones Indices. Nvidia led the group with a gain of about 239%. Btw, the S&P fell by 8.6 percent between July and October. So, as is generally the case, investing in the stock market was a wild ride.

What was the inflation rate over the past year?

a. 8.3 percent

b. 7.9 percent

c. 6.6 percent

d. 4.2 percent

e. 3.1 percent

f. 0.1 percent

And the answer is …

The answer is 3.1 percent. Prices rose by only 0.1 percent over the past month.

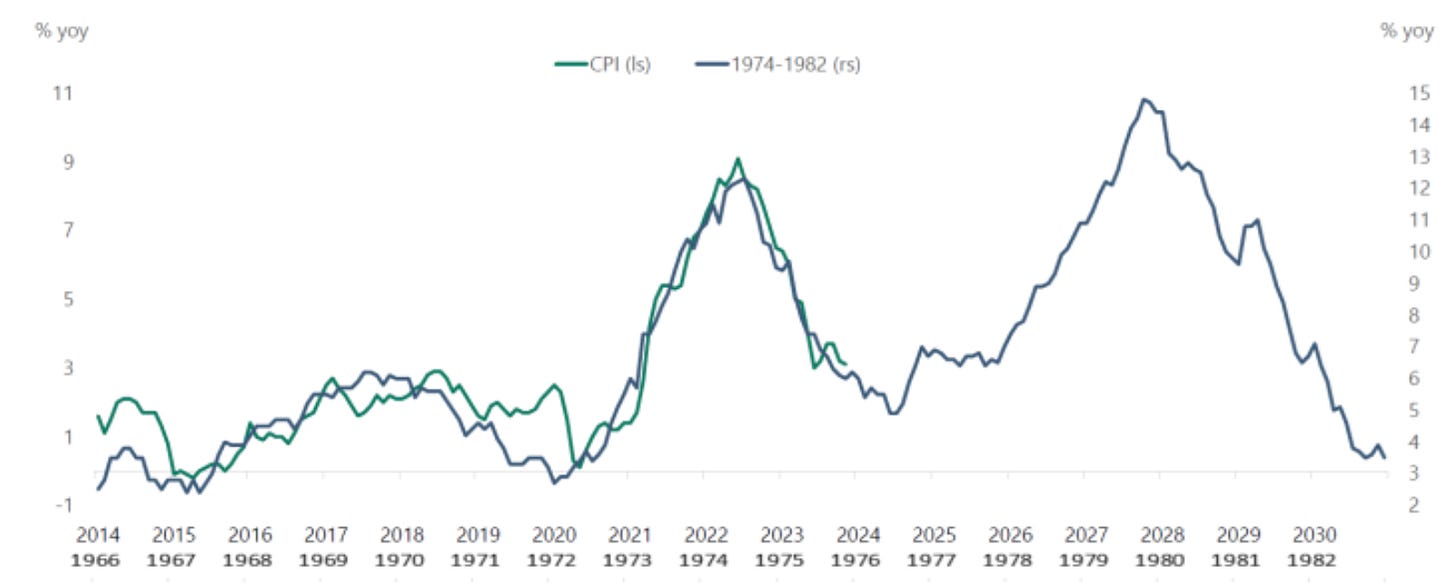

The decline in inflation was much faster than expected. Will it continue? Here’s a super scary chart from Torsten Slok, Chief Economist and Partner at Apollo Global Management. It shows essentially identical paths of inflation between 1966 and 1975 and between 2014 and 2023. The two curves are offset by about 2 percentage points with the left axis referencing the inflation rate in the earlier period. After 2023, the black curve shows where inflation will go if it follows the pattern — the rise and fall — that inflation took between 1975 and 1983. It suggests inflation could soar back heading reaching as high as 15 percent over the next five years. This is a bit of statistical voodoo. But the two patterns are eerily similar to one another.

What European country has defaulted most often on its national debt since the year 1000?

a. Greece

b. England/UK

c. Spain

d. Russia

e. Hungary

And the answer is …

The answer is Spain, which defaulted 13 times since 1476. England/UK defaulted first — in 1066 when William the Conquer showed up. It hasn’t defaulted since. France and Germany have both defaulted 8 times. The U.S. has, arguably, defaulted 4 times in its 247 years.

Please share larrykotlikoff.substack.com with all your friends and family. And please sit down with the best financial planning tool in the world — maxifiplanner.com — and make sure you aren’t spending too much, too little, or simply leaving a lot of money on the table. If you are using a financial planner, ask your adviser to run you through the tool. Also, if you are collecting Social Security, please use maximizemysocialsecurity.com to check you are receiving the right amount. As my new book, Social Security Horror Stories, with Terry Savage, shows, there’s a very good chance Social Security is overpaying you as well as a decent chance it’s underpaying you.