China’s estimated vacant housing suffices to house all of

a. Brazil

b. New Zealand

c. San Francisco

d. Angola

e. Dallas

And the answer is …

The answer is Brazil. China is estimated to have 90 million vacant homes. Wow! How could this have happened? Part is demographics. Part is the only recently lifted restriction on owning just one home. Part is restrictions that make it tough for foreigners to buy homes. And part appears to be an oversupply of housing by construction firms, some/many of which are government-sponsored. Last year Chinese house prices declined by a massive 25 percent!

What’s the projected decline in China’s population between now and 2100?

a. Negative 18 percent

b. Negative 7 percent

c. 17 percent

d. 39 percent

e. 62 percent

And the answer is ..

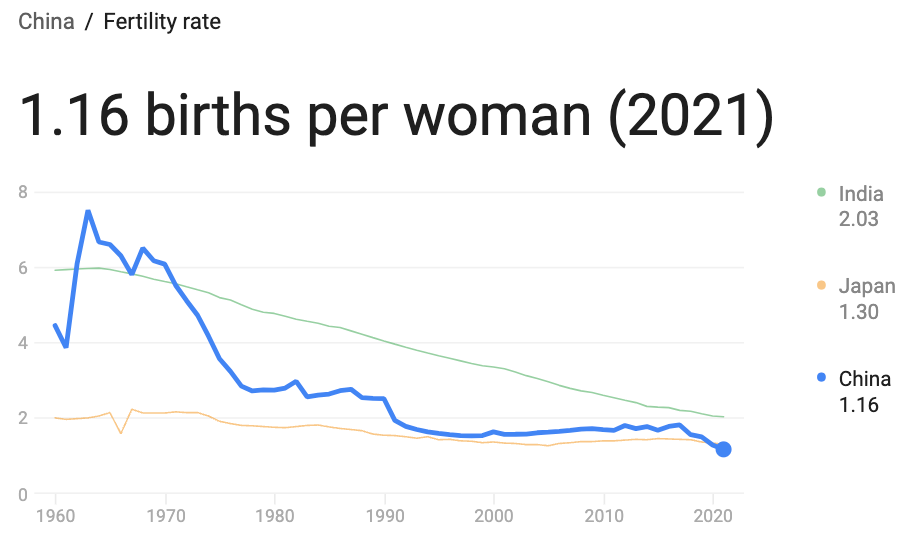

According to one study out of Shanghai Univeristy projects China’s current 1.4 billion population will fall to 525 million by century’s end — a 62 percent drop! The United Nation is more optimistic. It projects China’s 2100 population at 770 million — a 45 percent decline. This is far larger than its pre-COVID 400 million projected decline. Clearly, demographic projections are far from trustworthy. Although China abandoned its post-1979 one-child policy in 2016, young couples are now having fewer than one child. The chart below, care of The World Bank, shows a steady decline in China’s fertility rate. Three years ago it was 1.16 births per woman of child bearing age. It takes two to tango and a 2.1 fertility rate to keep a country’s population stable. This ignores net immigration, which appears low on China’s to-do list. The 2.1 reflects the need for each woman to reproduce herself and her male mate. The 0.1 bit adjusts for newborn mortality. Will countries headed for population extinction, Korea is at the top of the list, start producing baby factories using surrogate moms or artificially inseminating artificial embryos?

Insurers have raised prices and deductibles on hurricane-related damage. Some have stopped providing flood insurance. Losses from Hurricane Helene may reach $26 billion. What is the low estimate of the amount that will be covered by insurance?

a. $5 billion

b. $8 billion

c. $15 billion

d. $21 billion

And the answer is …

The answer is $5 billion. Many people simply could not cover the cost of coverage. Others weren’t able to buy or afford flood insurance. And those with even the best policies aren’t fully covered due to high deductibles. As I write, another hurricane, Milton, is gathering strength in the Gulf of Mexico, imperiling the same areas hit by Helene.

You need 40 Quarters of Coverage to be eligible to receive Social Security retirement benefits and to ensure you can potentially provide your dependents and ex-dependents with spousal, divorced spousal, widow(er), divorced widow(er), child, disabled adult child, child survivor, disabled child survivor, parent, and death benefits — all of which my company’s $49 MaximizeMySocialSecurity.com tool will calculate for you in the process of finding what benefits to take and when in order to maximize your lifetime benefits. I just asked Google a question to which I knew the answer: Can you earn 4 quarters of Social Security coverage in a single day? Here’s its AI answer: No, you cannot earn 4 quarters of Social Security coverage in one day.” Is this answer

a. Correct

b. Wrong

And the answer is …

The answer is wrong. The second part of the AI-generated answer, which contradicts the first part, gets it right. The maximum you can earn in a year is 4 quarters, and this limit is based on your total earnings throughout the year, meaning you can only earn a maximum of 4 credits regardless of how quickly you earn the required amount within that year. In 2024, you need to earn $1,730 in covered employment — a job whose pay is subject to Social Security’s FICA tax — to receive one quarter of coverage. If you earn $6,920 in covered employment for working one hour or, for that matter one nano second, you’ll receive 4 quarters of coverage.

As he helps raise his children, Joe works sporadically in covered employment between ages 21 and 41, earning 39 Quarters of Coverage. Then he works as a teacher in Massachusetts in non-covered employment. Joe has a deadly stroke at age 64 while grading a geography exam and discovering that thirty percent of his 12th grade class can’t identify the Pacific Ocean. Joe’s wife, Sally, age 61, files for a widow benefit. Is she eligible to collect?

a. Yes

b. No

And the answer is …

The answer is no. Yes, Joe had the minimum number — 6 — of Quarters of Coverage (QCs) needed to provide Sally a widows benefit. But to be fully insured to provide survivor benefits, his QCs need to exceed the number of years between 21 and the earliest of the year he dies or reaches 62. That’s 40 years if I have my math right. Had Joe earned just one more QC, Sally would be eligible to receive a widow benefit for the rest of her days. The moral of this story. Before you do anything regarding Social Security, including choosing not to work in covered employment, shell out $49 on Maximize My Social Security so you don’t lose tens if not hundreds of thousands of dollars. Better yet, run MaxiFi Planner so you don’t unnecessarily also pay tens to hundreds of thousands of dollars in extra lifetime taxes

Single, retired Sally is 62 and has $2 million in an IRA and $3 million in regular assets. She is taking Social Security at 70 when her annual benefit will be 76 percent higher, adjusted for inflation. At 70, Sally is also going to start receiving a union pension of $160K (not indexed). How much, in present value, can Sally lower her lifetime taxes and raise her lifetime benefits using Roth conversions?

a. $17,321

b. $61,888

c. $103,771

d. $188,113

e. $321,109

And the answer is …

The answer is $188,113! My company has just rolled out Robo-Roth Conversion in our MaxiFi Planner Premium and PRO software tools. (This is in addition to robo optimizing over Social Security benefit-collection decisions, the decision of whether to take Roth withdrawals first or second, and when to start regular retirement account withdrawals — available in all three MaxiFi tools.) The new algorithm determines the exact amounts to convert each year to reduce your lifetime taxes to the maximum extent possible.

That’s based on our most efficient algorithm. Finding the optimal timing and level of Roth conversions is, mathematically speaking, a highly non-linear problem involving a slew of tax elements, from current and future federal tax brackets to current and future Medicare IRMAA premium brackets to current and future Social Security benefit taxation under the federal income as well as ten state income taxes.

Given this non-linearity, the optimum Roth conversion surface is often quite flat. I.e., there may be nearby solutions that may do almost as well or even slightly better. Hence, you may be able to save a few more dollars in lifetime taxes by manually tweaking MaxiFi’s solution by a) incorporating its answer and b) experimenting with alternative profiles near MaxiFi’s supplied optimum.

If you are using some other tool to figure out how much to Roth convert and when to do so, please run MaxiFi. None of Wall Street’s algorithmically primitive tools are able to get this right. Hence, their recommendations can easily raise, not lower your lifetime taxes. I’ll be writing and podcasting about MaxiFi’s Robo Roth Conversion later this month. If your advisor, be they a CFP or a CPA or any of FINRA’s other 238 designated professional designations, has given you a Roth conversion plan, insist they run you through MaxiFi Planner. In many cases, your planner is being told by their financial sponsor what sales-oriented tool to use on you. Please read this article to see what you have “chosen” and how much financial risk you may be facing. If you are a financial advisor, read the article to consider how much legal liability you may be facing using Wall Street’s sales-oriented, conventional planning tools without also showing your clients the economics-based planning alternative.