Federal debt held by the public (not held by the Fed) is currently 97 percent of GDP. What is the Congressional Budget Office’s (CBO) 2034 projected level of federal debt as a share of GDP

a. 85 percent

b. 92 percent

d. 104 percent

e. 116 percent

f. 135 percent

And the answer is …

The answer is 116 percent. This is the CBO’s latest 10 year forecast. Revenues are projected at 17.8 percent of GDP through the next decade. That’s higher than the 17.3 percent average recorded over the past 50 years. But outlays are projected to average 23.5 percent of GDP between now and 2034. That’s a lot higher than the last half century’s 21.0 percent average value. The CBO projects official debt at 160 percent of GDP by mid-Century. That’s twice the current Argentine value.

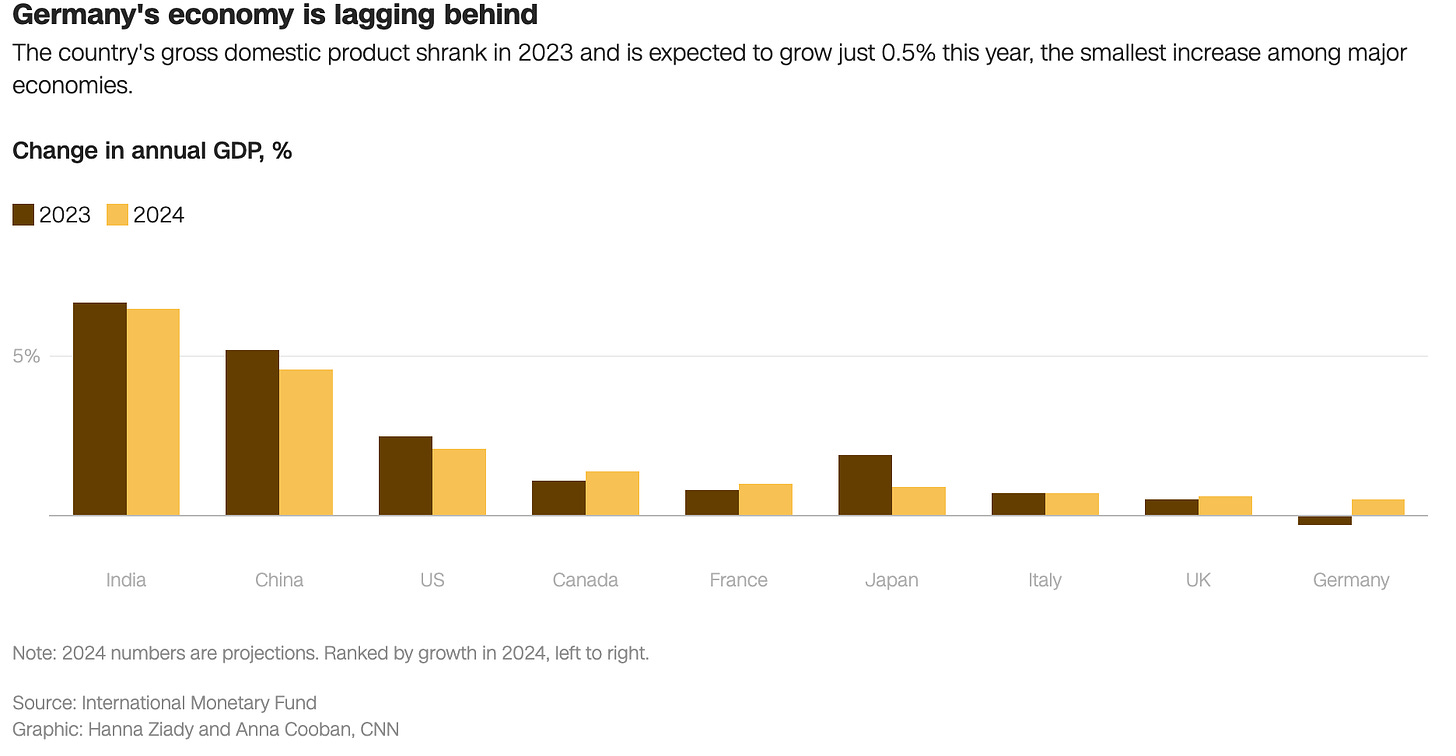

Did Germany’s GDP grow last year?

a. Yes

b. No

And the answer is …

The answer is no. As this IMF chart shows, Germany’s economy shrank last year. Meanwhile, China’s economy rose by 5 percent despite its ongoing decline in population. U.S. growth was 2.5 percent, nothing to cheer about, but better than expected.

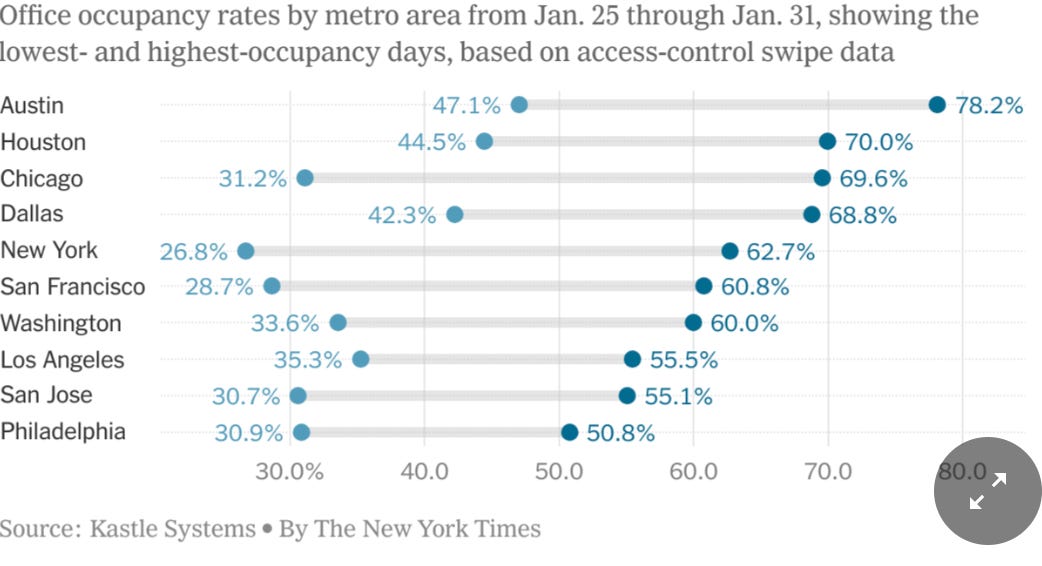

Is the office vacancy rate rising or falling?

a. Rising

b. Falling

And the answer is …

It’s rising. According to Moody’s Analytics, the purported back-to-the-office requirement is mostly rumor. The office vacancy rate is 19.8 percent — a record high. Check below for a very telling chart. The big questions here are how the banks will fare since they have financed much of U.S. office space. As Peter Coy, the fabled NY Times economics columnist, puts it, The low occupancy rate is a ticking time bomb for owners of office buildings. When leases expire, tenants won’t want as much space as they have now. Vacancy rates will shoot up. The price of NY Community Bancorp stock, which is heavily exposed to commercial real estate, has dropped 60 percent since January. Bank shares, in general, have continued to fall. As leases come due, rents will surely fall, putting more pressure on the ultimate owners of so many little used office buildings around the country. Could this augur another bank run? Absolutely. Look at the final chart — of office use over the week in top metro areas. There are days in each city where less than half of commercial offices are being used. On one or more days in a given week, almost three in four commercial offices are empty. In short, the labor unemployment rate is low, but the real estate commercial capital unemployment rate is massive and rising!

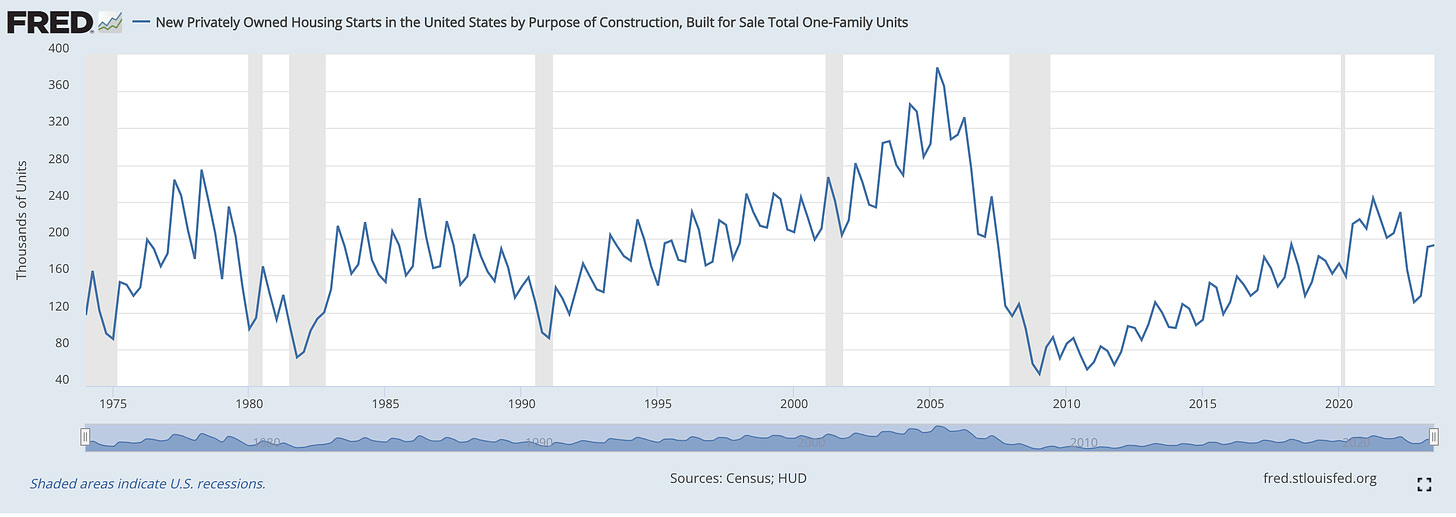

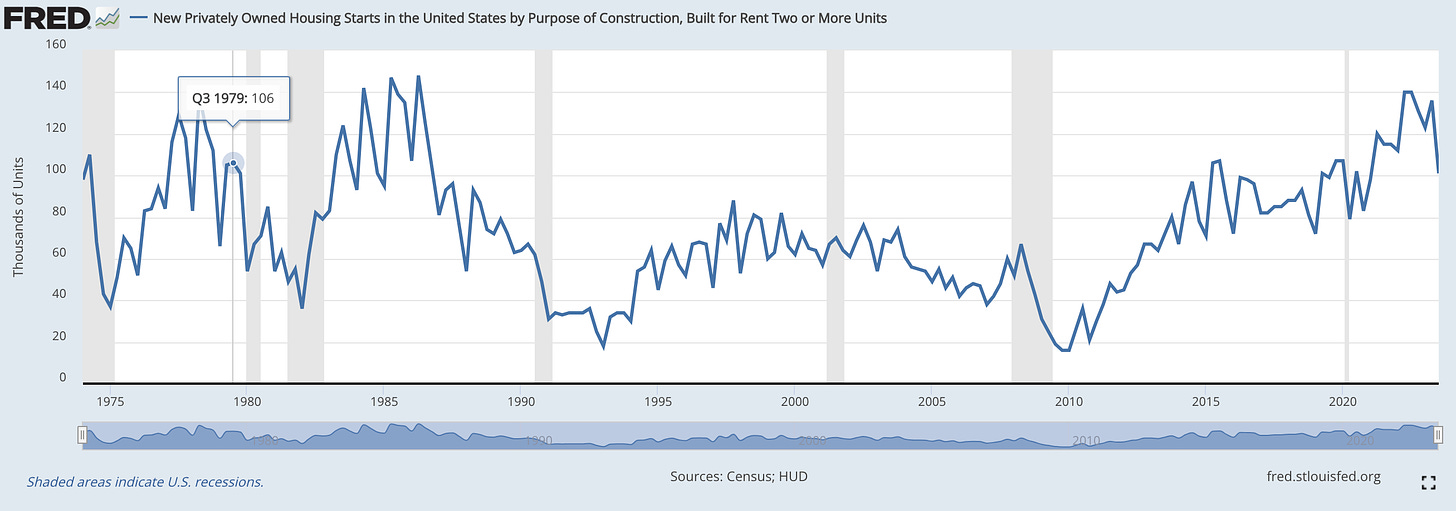

Are Annual New Private Home Starts Higher or Lower than in 1976?

a. Far higher

b. The same

c. Far lower

And the answer is …

As the first chart below, from the St. Louis Fed, reports, it’s the same even though the population of those 25 to 54 has more than doubled since 1976. Over this period, new rental unit starts have almost doubled. For young people asking why they can’t afford to buy a home, the answer is simple — the construction industry is building rental units not private detached homes or condos. Why? Since 1960, the ratio of urban to rural dwellers has almost doubled. The only place to build in a city like Boston is up. The suburbs aren’t changing their zoning to accommodate high-rise condos. And there are no vacant lots. Building up in the city means building rental units or condos. But real estate developers don’t want to deal with condo boards during or after construction is complete. Young people can get into real estate by buying and renting, via Airbnb, VBRO, etc., homes that are both affordable and rentable. Or they can simply invest in real estate investment trusts (REITS).

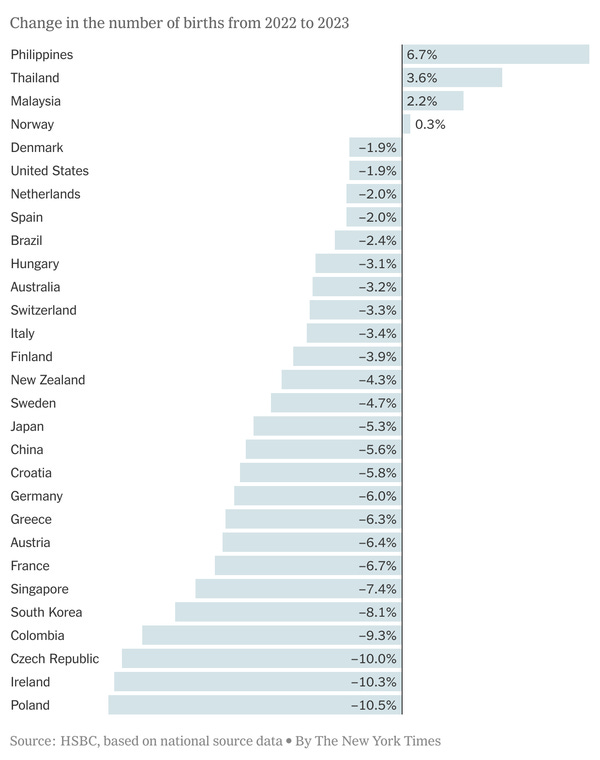

Are we in the midst of another baby bust?

a. Yes

b. No

And the answer is …

The answer appears to be yes. Please check out the following chart discussed in NY Times columnist, Peter Coy’s, article. Peter, btw, is my favorite economics columnist/analyst. Check out my podcast with Peter that will be released this Thursday. And if this Thursday is in the past, you can find it at larrykotlikoff.substack.com. As the chart show, three countries of the 28 listed experienced more births in 2023 than in 2022. But 25 saw births drop. In Poland, Ireland, and the Czech Republic births dropped by more than 10 percent! In Germany and China they fell by 6.0 percent and 5.6 percent, respectively. The drop in the U.S. was 1.9 percent.

And now, a short ad re Plan With Larry:

As most of you know, my company markets MaxiFi Planner and Maximize My Social Security. These are amazing economics-based financial planning tools, which we license to households and financial planners. But not everyone wants to use software to answer their financial questions. Hence, we’ve decided to offer a new service. You can now hire me to plan for you. Just click here and choose Larry Plans for You. To be clear, I don’t have a CFP, RIA, or any other financial planning designation. I’m not a financial planner. I do have a PhD in economics. You can check my background at kotlikoff.net. If you sign up for the service, my colleagues will collect some data from you and produce a basic plan. Then I’ll zoom with you to review it and improve it. This is a purely educational service. I can’t and won’t provide investment advice. But I’ll show you how to use MaxiFi Planner to analyze your investments and also, as you wish, connect you with planners using MaxiFi who do provide investment advice and also investing services. Plan with Larry is hands off from your side, but you’ll still get a free license to MaxiFi Planner in case you wish to get hands on.

What fraction of low income Black and Hispanic households have retirement accounts?

a. 40 percent

b. 30 percent

c. 20 percent

d. 10 percent

e. 5 percent

And the answer is …

The answer is 10 percent. This is based on 2018 data reported by the GAO. The chart below shows that retirement accounts and the lifetime tax breaks they provide are disproportionately going to high-income households. But even among high income households, the use of these accounts is less than 75 percent, on average.

Please tell everyone you know that they can receive a free lifetime subscription to my newsletter and podcast by emailing me at kotlikoff@gmail.com. I will bug them, as I do you, in my newsletters to subscribe. But that’s secondary to my conveying sound economic analysis to as many people as I can. I do get geo-political from time to time, but no one needs to read my political views unless they are interested.

Good catch, teach! Jerry, I put this in there to make sure you still have your red pencil handy. It's been a long time since you taught me English in 8th grade.

Fixed on line.

Love to you and Ken, Larry

Uh, isn't number three's answer a mistake? The office occupancy rate is falling, not its vacancy rate, no? Certainly that's what the explanation says. BTW, I love The Financial Riddler. I have learned so much.