The Financial Riddler 3-8-23

This Riddler comes curtesy of Roger Lowenstein, our nation's bestselling financial historian. Today's questions are based on Ways & Mean, Roger's must-read book about the financing of the Civil War.

As this podcast makes clear, Roger Lowenstein is the national gift that keeps on giving. Over the years, I’ve talked to central bankers, top finance professors, Treasury secretaries — you name it. I’ve never met an observer of the financial system with a deeper understanding of theoretical and practical workings of the financial system, past and present, than Roger Lowenstein. My intellectual love affair with Roger began with his best seller, When Genius Failed — the Rise and Fall of Long-Term Capital Management. It’s a riveting narrative of the company’s tremendous rise and far more tremendous collapse. The book’s an on-going reminder of our financial system’s financial fragility, which was on full display in the Great Recession. Roger’s latest book, Ways and Means — Lincoln, His Cabinet, and the Financing of the Civil War is a true must read — for students of history, the Civil War, politics, economic policy, and financial-market. Set aside a couple days with nothing critical to do. You won’t be able to put it down.

Today’s Ridder is contributed by Roger based on Ways and Means. Let’s see how you do!

1. Over the course of the Civil War, inflation in the Union states totaled approximately

a) 30 percent

b) 60 percent

c) 80 percent

d) 120 percent

And the Answer is …

The answer is 80 percent.

2. The inflation in the North was

a) higher than inflation during World War I

b) lower than during World War 1

c) approximately the same

And the Answer is …

The answer is approximately the same.

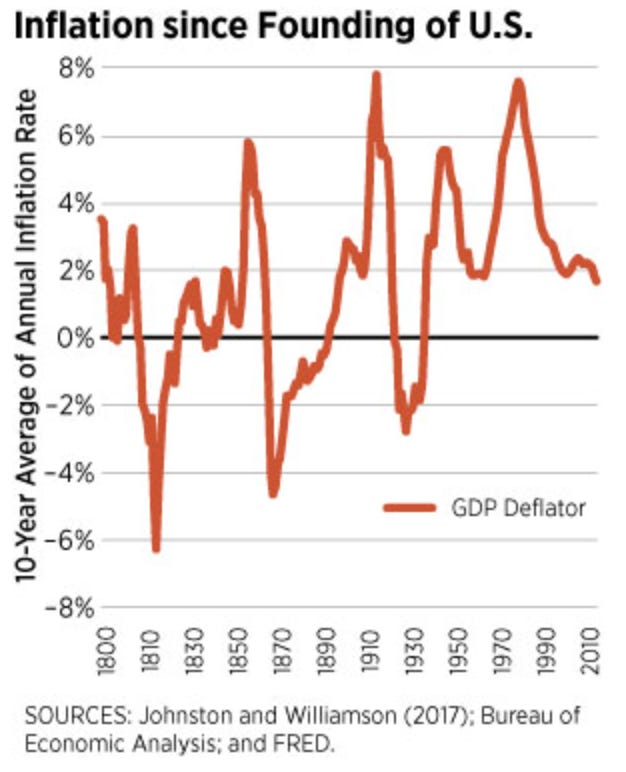

Fyi, here’s a chart of annual inflation since 1800.

3. Over the course of the Civil War prices in the Confederate States rose

a) 100 percent

b) 200 percent

c) 1,200 percent

d) 9,000 percent

And the Answer is …

The answer is about 9,000 percent. A barrel of flour in Richmond cost $5.50 at the outset of the war. By the end, it cost $1,000.

4. In 1860, just before the Civil War, the U.S. budget totaled $77 million. By 1865, the budget was

a) $280 million.

b) $560 million

c) $1.3 billion

d) $2.1 billion

And the Answer is …

The answer is c or, more precisely, $1.29 billion. During the four years of fighting, the U.S. spent $3.35 billion—more than in all the years since the beginning of the Republic combined.

5. To help pay for the war, the Union, in 1862, legislated the country’s first income tax. What was the tax rate?

a) 2 percent

b) 3 percent

c) 6 percent

d) 10 percent

And the Answer is …

The answer is 3 percent. The tax kicked in at $600. For incomes above $10,000—then quite rare, the tax rate was 5 percent.

6. After the Revolutionary War, the U.S federal debt was $75 million. By the eve of Lincoln’s election in 1860 the debt had risen to

a) $90 million

b) $120 million

c) $200 million

d) $245 million:

And the Answer is …

The answer is none of the above. In 1860, the debt was $65 million, less than in General Washington’s time. But by the end of the Civil War, the debt had risen 43 times, to $2.8 billion!

7. In 1862, the U.S. issued a fiat money known as legal tender notes or “greenbacks.” The following year, the Lincoln government legislated a new system of federally regulated banks, which circulated yet another currency, “national bank notes.” Both were meant to be a uniform currency, circulating throughout the nation. Prior to the war, each state had its own money, consisting of notes issued by local banks. Under the old system, how many different bills circulated in the United States?

a) About 40

b) about 200

c) about 3,000

d) more than 8,000.

And the Answer is …

The answer is d. In 1863, the Chicago Tribune counted 8,370 different bills—and only in the Union states. These notes—essentially IOUs—were the country’s money, each one valued according to the issuing bank’s reputation and generally discounted (sometimes greatly) the further one traveled from the issuing state.

It's cumulative inflation over the 4.something years.

Agree!

best ,Larry