Let’s see if I can rattle your financial self confidence. I’ve certainly rattled my own searching for these answers.

If we index March 2020’s NY City’s use of its office space capacity at 100 percent, what’s its use of office space capacity now?

a. 95 percent

b. 84 percent

c. 72 percent

d. 45 percent

e. 32 percent

And the answer is …

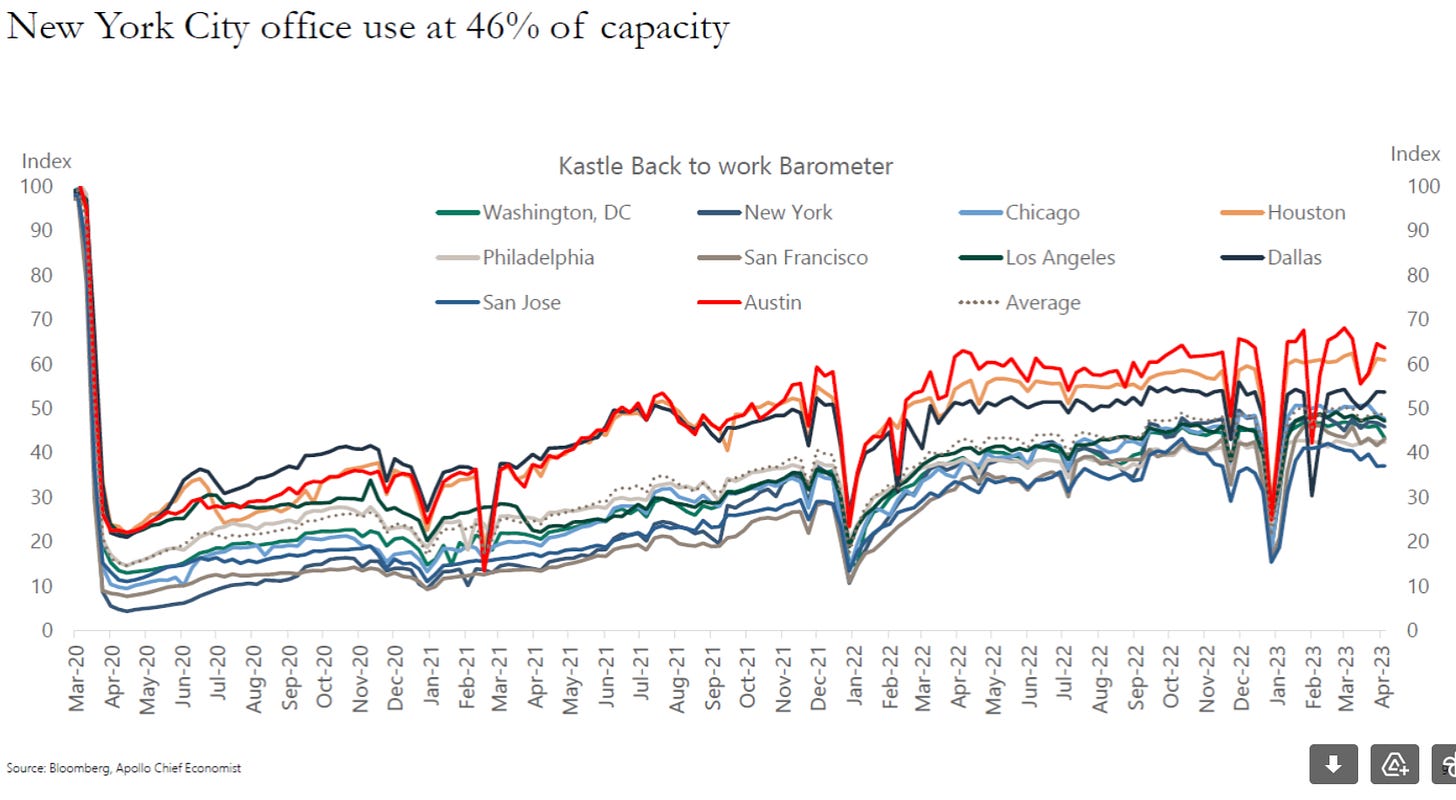

The answer is 45 percent. This is dramatically higher than the roughly 15 percent figure recorded at the onset of COVID. But it’s still remarkably low. The story, as the figure below, courtesy of Apollo’s Torsten Slok, shows holds across all major cities in the country. Since we are at essentially full employment, this means that office workers are only going in half time. That, in turn, says we effectively have twice the office space we had before COVID.

How much has the dollar value of sales/rentals of office space risen or fall over the past year?

a. Risen by 21 percent

b. Risen by 57 percent

c. Fallen by 17 percent

d. Fallen by 65 percent

And the answer is …

First quarter (Q1) rents for inner city office rental space dropped 65 percent compared with a year back. Vacancy rates for office buildings are at a record high — close to 20 percent. The broader concern? Many small and medium-sized banks who specialize in financing office buildings could go under especially if they followed the advice of our economics-challenged accountants at the Financial Accountings Standards Board and marked long-term Treasuries and other “safe” assets to book, not market. (See this newsletter). The other side of the coin is that other parts of commercial real estate — warehouses, industrial space, hotels, etc. — are doing fine. Overall, though, bank stocks are down a quarter from this time last year.

Are prospects for a recession rising or falling?

a. Rising

b. Falling

And the answer is …

Recession fears seem to be fading. We are seeing a small uptick in commercial bankruptcies. On the other hand, mortgage delinquencies are down. And the unemployment rate remains at essentially a postwar low. But, but. New orders in manufacturing are down as is bank lending. Credit card delinquency rates are starting to head north. In short, we have the same mixed news we’ve seen over the last years.

Former Treasury Secretary Lawrence Summers is, as ever, predicting economic decline. Larry was a classmate of mine in grad school and former co-author. He’s a smart dude, but will say X when everyone else is saying Y just to be contrary. When Y turns out to be correct, he’ll change the subject and start predicting Z. Attention is the objective. Summers is not unique. Any highly confident economic prognosticator or stock picker, regardless of their pedigree, is likely full of white noise.

Is China now the equal of the U.S. in terms of number and quality of patents?

a. Yes

b. No

And the answer is …

According to this new study, the answers is pretty much yes or close to yes.

According to the latest Social Security Trustees Report, in order for the system to continue to pay promised benefits through time, Social Security needs to raise its 12.4 percentage point payroll tax immediately and permanently by

a. 0.3 percentage points

b. 1.9 percentage points

c. 2.7 percentage points

d. 3.4 percentage points

e. 4.6 percentage points

And the answer is …

The answer is 4.6 percent! That’s a whopping 37 percent hike! The system’s $66 trillion unfunded liability is 2.7 times official federal debt held by the public! Have you heard President Biden mention this tiny fact? Former President Trump? Florida Governor, Ron DeSantis? Nikki Haley? Chris Christie? What about Steve Laffey, a Republican dark horse candidate? Laffey has Social Security’s long-term problem front and center on his website. The other candidates are leaving it “off-the-table.” DeSantis may have banned its discussion.

What extra type of insurance do you receive when you take out a mortgage?

a. Title insurance

b. Homeowners insurance

c. Inflation insurance

And the answer is …

The answer is inflation insurance. Title and homeowners insurance you need to buy. But if inflation takes off, you get to pay back your mortgage in watered down dollar. Hence, today’s high mortgage rates make mortgages look more expensive then they really are.

What share of U.S. developers of Chat Bots are foreign born?

a. 27 percent

b. 37 percent

c. 57 percent

d. 77 percent

And the answer is …

The answer is 77 percent. Meanwhile, we make it incredibly hard for top scientists and engineers who obtain employment in our country to stay in our country beyond a couple of years.

What’s Vietnam’s per capital GDP? The U.S. value is $70,480. Singapore’s is $82,794. China’s is $12,556.

a. $3,110

b. $4,162

c. $7,982

d. $43,909

e. $61,222

And the answer is …

The answer is $4,162. Vietnam is poor, but, full of hard-working people. That’s, in part, why Apple is moving some of its iPhone production from China to Vietnam.

How many of the twenty G20 countries are considering issuing digital currency?

a. None

b. Four

c. Seven

d. Nineteen

And the answer is …

The answer is nineteen! China already has its own digital version of the Yuan called the e-CNY. Once Americans have the ability to hold digital dollars issued by the Fed, we’ll have, in effect, the cash mutual funds described here.

I agree, And yes I was verbose, but I have found that I needed to explain how money is created as well as the cause of inflation (or one of the cause), even to economic professors. For instance my Econ professor in University. After graduation, I presented him with my paper, and all he could say was I don't understand money. You have done a great job of explaining how the US dollar is valued. I thank you for that.

When you talk of digital dollars held by the Fed. Please elaborate. Do you mean cyber dollars, or Federal Reserve Notes, the majority of which are digital. (Paper money is small change, printed by the Treasury and sold to the Fed for cost of printing, and put into circulation by Federal Reserve regional banks, to faciliate commerce,like vending machines, street corner vendors and drug dealers. I have a$20 note in my wallet for emergencies, it has lain their untouched for years. All of my deposits, all of my transactions are digital, pretty much the same for everyone else. If an employer prints a pay check, it is deposited in a bank or credit union, if the company is big enough, then the deposit is made electronically.

So what is meant by digital?