For a free, lifetime subscription to Economics Matters, just email me (kotlikoff@gmail.com) your email address and those of everyone else — kids, parents, friends, relatives, colleagues — you’d also like to have one.

How many mega cities (population over 10 million) are there in China?

a. 3

b. 5

c. 7

d. 13

e. 17

f. 21

And the answer is …

The answer is 17. Shanghai tops the list with 25 million people. China has half the worlds megacities. The U.S. has none. New York’s population is less than 9 million.

What was New York’s population in 1790?

a. 1.1 million

b. 470,000

c. 88,000

d. 53,000

d. 33,000

f. 19,000

And the answer is …

The answer is 33,000. This is very small given that the population of the 13 colonies was 2.5 million at the time of the revolution. England, by the way, had about 7 million people in 1776.

What was Iran’s per capita GDP in 2022?

a. $41,222

b. $32,743

c. $27,690

d. $13,018

e. $4,669

And the answer is …

The answer is $4,669. By comparison, U.S. per capital GDP in 2022 was $62,789. Israel’s was $54,930.

What is Americans’ average age of retirement?

a. 55

b. 58

c. 62

d. 65

e. 67

f. 70

And the answer is …

The answer is 62. This is incredibly young. It means that many retirees will spend more years playing pickleball than they spent working. It also means that a large share of retirees will run out of money years before they run out of breath. Worse yet, retiring early using comes along with taking Social Security early. This, as my company’s dirt-cheap, incredibly precise, Maximize My Social Security tool, which thousands of people like you have run all on their lonesome, shows is a second act of financial suicide. The median age of retirement is also around 62. This means half of American workers are calling it quits, work wise, before age 63.

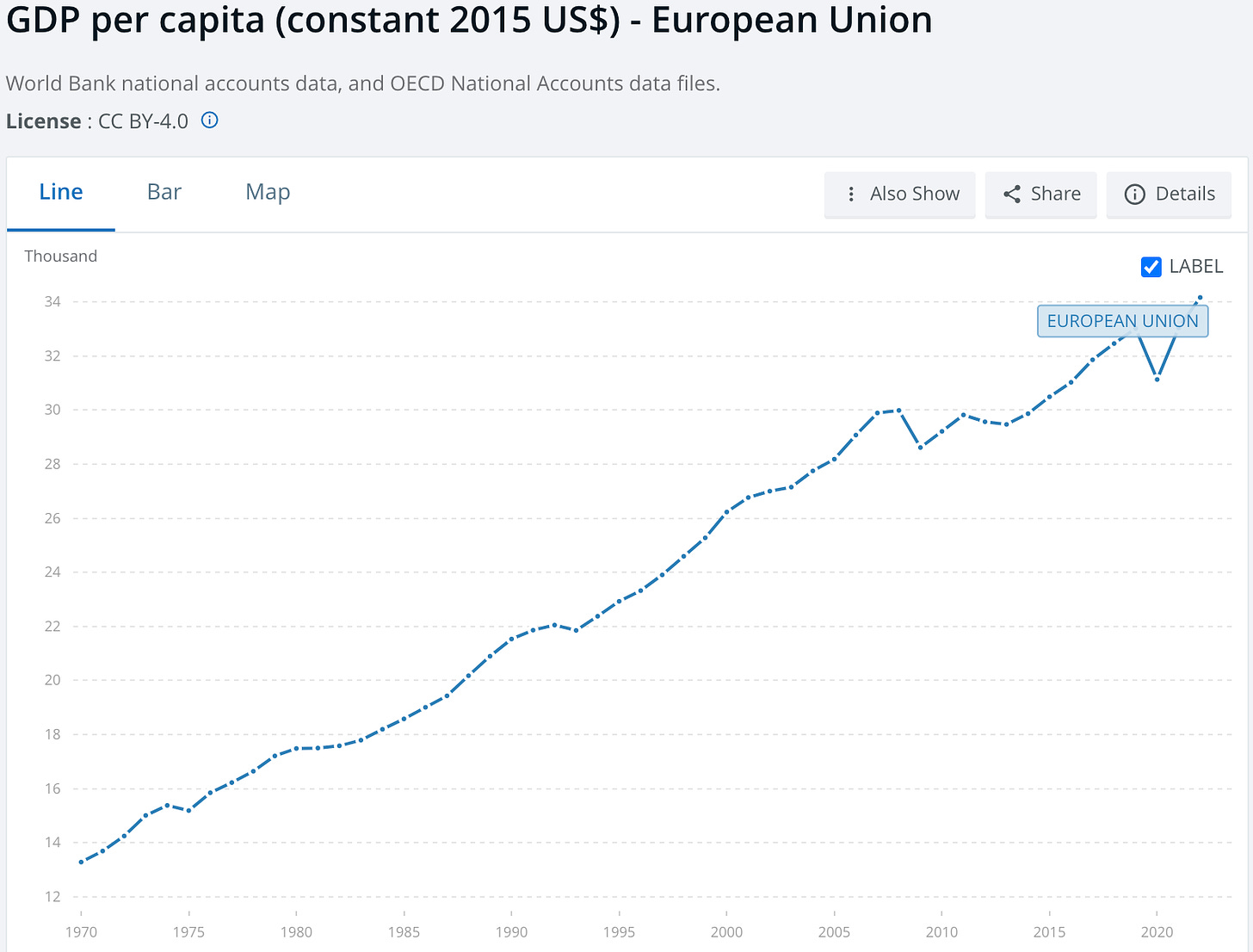

How much higher was per capita GDP in the Eurozone in 2022 than in 2008?

a. 20 percent

b. 14 percent

c. 8 percent

d. 4 percent

e. 3 percent lower

And the answer is …

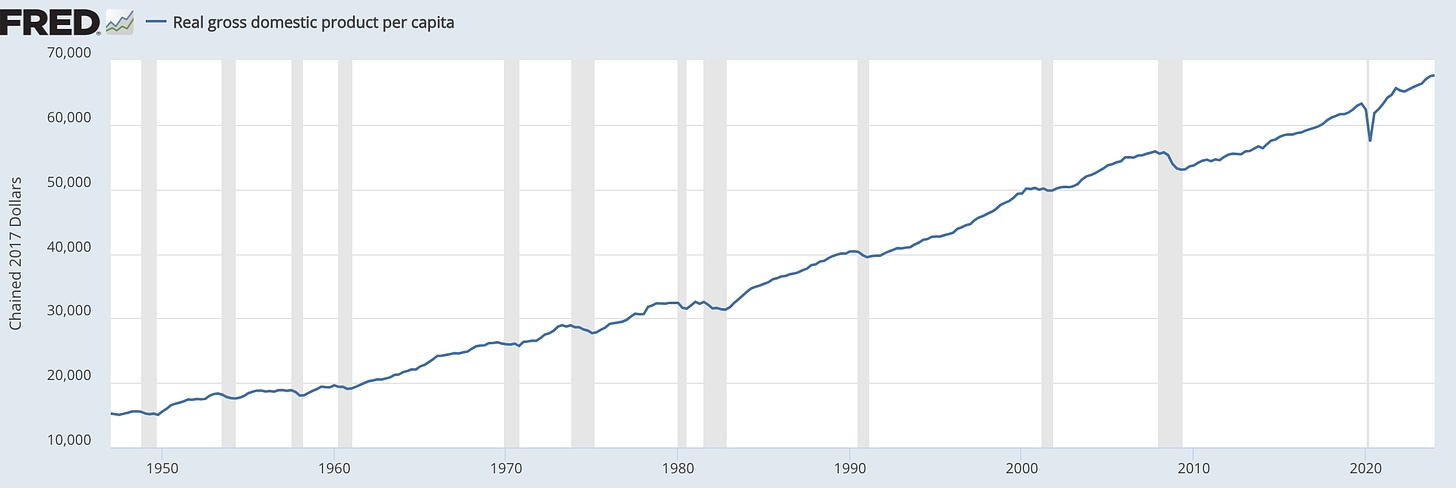

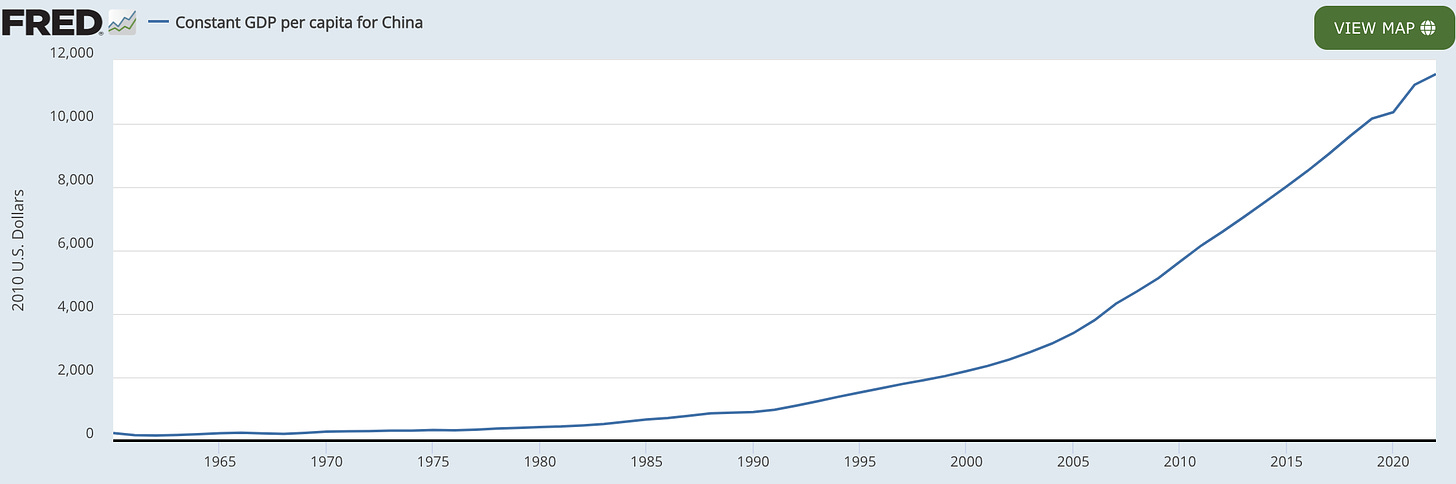

And the answer, as the first chart below shows is 14 percent higher! That’s roughly 0.9 percent growth per year. This is beschissen, as the Germans would say. The second figure consider real U.S. per capita GDP over time. Our living standard through 2022 is 22 percent higher compared with 2008. That’s roughly a 1.4 percent annual compound growth rate — decent, but nothing to write home about. What about China? As the third chart shows, its per capita GDP grew 145 percent between 2008 and 2022! That’s a 6.6 percent annual compound rate! China, in short, is eating our economic lunch.

Euro Zone Real Per Capita GDP

U.S. Real Per Capita GDP

Chinese Real Per Capita GDP

Is the current (as of June 20, 2024) real yield on inflation-indexed 30 year Treasury bonds (TIPS, which stands for Treasury Inflation Protected Securities) above 2 percent?

a. Yes

b. No

And the answer is …

The answer is yes. As I write, the 30-year TIP is yielding 2.10 percent. This is the highest real interest rate in 15 years. See zvibodie.com for the latest yields on TIPS of various maturities.

If you are 60 and want to have a constant real income stream through age 100 and could earn 2 percent real, how large a stream could you buy with $1 million. Ignore taxes.

a. $41,891

b. $36,556

c. $27,992

d. $16,789

And the answer is …

The answer is $36,556. If the real return were zero, the answer would be $25,000. If it were negative 0.5 percent, as was the case on December 1, 2021, the annual real payment would be $22,521. That’s almost 40 percent less than $36,556. Hence, for those interested in locking in a decent real payment on their assets by buying TIPS, this seems a good time to consider doing so. Consider running Upside Investing in MaxiFi Planner and purchasing a ladder of TIPS to lock in the annual living standard floor the program generates plus payments for annual fixed expenses. Here’s a podcast I recently posted discussing Upside Investing. I’ll post another one shortly about buying a ladder of TIPS in support of Upside Investing’s guidance.

Will you be among more than half of Americans who will take the wrong Social Security benefits at the wrong time — leaving at least $182,000 on the table? PLEASE run Maximize My Social Security or, even better, MaxiFi Planner. If you don’t like to run software and want me to do so for you or simply want to consult with me about your financial decisions, including Social Security, please sign up for my Plan with Larry service.