This Is Not Your Grandfather's Investment Advice

Investing these days is really tough. Fortunately, economics-based financial planning offers clear ways to invest at risk while limiting or, indeed, eliminating your living standard downside. Larry Kotlikoff is a Professor of Economics at Boston University and the founder and president of Economic Security Planning, Inc.

These are tough times for investors in risky assets. No matter the asset class, there’s a nightmare lurking. We hold cash and get wiped out by inflation. We buy stocks that immediately crash. Our bonds vaporize as Powell gets serious. We buy a new house just as the market peaks. We snap up bitcoin at the “bottom” and watch it crater. We buy foreign currencies and a global crisis strengthens the dollar. You get the picture.

What’s driving us nuts is not fear of losing our money. It’s fear of losing our lunch. Our bottom line is our living standard — what we get to spend, now and down the road. As any squirrel will tell you, running out of acorns mid-winter is no picnic. Running out of spending power mid-retirement is no different.

Safe Assets Only Investing

Fortunately, there are ways to play the market but still control your downside living standard risk — the chance of suffering a major drop in your sustainable spending. For starters, consider playing it perfectly safe by investing all your savings in Treasury Inflation Protected Securities (TIPTIP 0.0%S). These are Treasury bonds that are indexed for inflation. Treasury I-bonds, which are also inflation-protected government I.O.U.s, is an even better “safe” investment vehicle. But there’s an annual limit on the amount of I-Bonds you can purchase.

To be clear, TIPS and I-bonds entail some risk — hence the “safe.” Although it’s highly unlikely, Uncle Sam could default on his I.O.U.s. The for-sure risk is paying higher taxes thanks to inflation.

How come?

When inflation increases, TIPS and I-Bonds pay you larger coupon and principal payments to compensate your getting paid back in watered-down dollars. But those inflation-protection payments are taxable by the feds (fortunately not by the states). And, if inflation is high, the tax bite can be nasty.

The Safe Assets Only strategy involves a third risk — rollover risk. This references reinvesting the proceeds from your TIPs and I-Bonds investments but doing so at currently unknown future real yields.

Setting aside these concerns as well as all the other risks you face, the Safe-Assets-Only investment strategy lets you play the market safely — by simply ignoring it. Take a hypothetical, 50-year-old single Georgian named Sam. Sam’s major financial question is how to invest. Sam, you see, just retired with $5 million in regular assets. He has no other resources — no future Social Security benefits, no retirement accounts, no pension, no nothing, just $5 million. Sam wants to hold stocks, but is super nervous about losing money.

Suppose Sam follows the Safe-Assets-Only investment strategy. Further, assume that he can earn zero percent real investing in a ladder of TIPS. This is a conservative assumption since short-term TIPS are, as I write, yielding a slightly positive real yield and long-term TIPS are yielding 0.74% real.

In implementing this zero real return assumption in my company’s MaxiFi Planner financial planning, I assumed a 3% inflation rate and a 3% nominal interest rate.

Now, let me give you a quick quiz. Please guess Sam’s annual inflation-adjusted living standard — the amount in today’s dollars that he can spend each year through age 100 — his maximum age of life. Answering this question is far tougher than it seems. You need to factor in 50 years of future federal and state income taxes, Sam’s payment, after age 65, of Medicare Part B premiums and how my assumed 3% inflation rate impacts each of these elements.

Ok, time’s up. Take a guess.

The Answer

Let me provide some consolation in advance if your answer is miles off the mark. If you landed within 20% of the right number you’re far smarter than virtually all top PhDs in finance and economics who have taken similar quizzes from me and failed miserably.

The right answer is $83,414.

The PhDs typically are off by 20%. Some are off by 60%. No wonder. Solving the problem requires doing iterative dynamic programming. Nobody, not Albert Einstein reincarnated, can solve this in their head.

MaxiFi took less than a half second. That’s the power of three decades of professional engineering, amazing improvements in computer hardware, parallel and cloud computing, and patent-winning computational algorithms.

Upside Investing

To many people, spending $83K real a year through the end of their days would suit them just fine. But Sam? He’s been dreaming of retiring in Aruba, snorkeling in the morning, surfing in the afternoon, and Zooming with his dermatologist in the evening.

Sam runs MaxiFi’s new Upside Investing routine. Upside Investing, as I described in recent Forbes and Seeking Alpha columns, is simple as pie.

You invest in the S&P and TIPS/I-Bonds and specify a period during which you’ll convert your stocks to TIPS/I-Bonds.

You build a base living standard floor assuming all stock investments are lost.

You increase your living standard floor only when and if you convert stocks to TIPS/I-Bonds.

In short, you treat money in the market as gambling stakes. And you don’t spend any winnings until you’ve left the casino. In the meantime, you assume you’ll leave empty-handed and spend on that basis — at your base living-standard floor.

Once you exit Caesar’s Palace, you invest any winnings in TIPS or I-Bonds. This lets you permanently raise your living standard floor. Hence, subject to the above caveats, your living standard can only head north during your stock-conversion period — hence the name Upside Investing.

Another term for this, used by my Boston University colleague, Finance Professor, Zvi Bodie, is Safety First Investing. In his 2003 book with Michael Cowes called Worry Free Investing and in his 2011 book with Rachelle Taqqu, called Risk Less and Prosper, Zvi and his co-authors emphasize buying TIPS to indemnify specific spending goals. Upside Investing indemnifies your entire future base living standard floor.

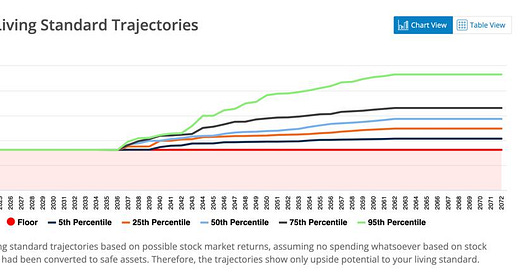

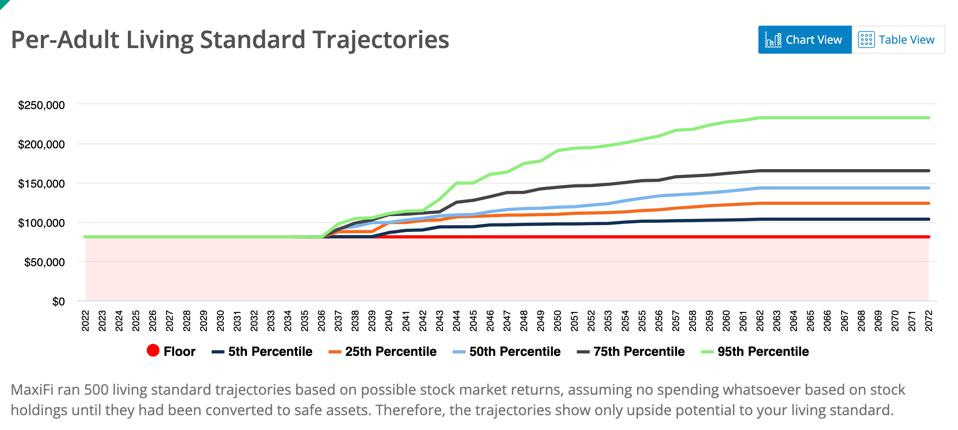

Let’s run Sam through Upside Investing assuming Sam invests just 20% of his regular and retirement assets in stocks and the rest in TIPS/I-Bonds. As the figure below shows, Sam’s base living standard is $67,125. That’s 20% lower than the Safe Assets Only strategy. So, Upside Investing involves a sacrifice — a one-fifth lower living standard until Sam reaches 65.

From that point on, Sam only experiences upside risk. The percentile curves show how much that might be. For example, the orange curve is the trajectory that generates the 25th highest realized lifetime spending. After Sam has fully converted, at his chosen conversion end age of 85, his annual spending on this trajectory is $106,704. The higher percentile trajectories — those with realized lifetime spending ranked 25th to 100th — do even better. Hence, Sam has a 75% chance of winding up on one of the 25th to 100th highest trajectories, each of which comes with a living standard that’s at least two-thirds higher than Sam’s $67,125 baseline. Sam’s 50th percentile ends up above $130K. Hence, he has a one-in-two chance of ultimately doubling his base living standard.

What if Sam’s stocks do poorly? They could, in the extreme, go to zero. In this case, Sam will be left spending $67,125 right to the point his personal video game flashes Game Over. Losing everything is, of course, highly unlikely. What about Sam’s landing on the 5th highest percentile. In this case, Sam’s ultimate living standard floor is $91,027, which is higher than his Safe Assets Only living standard. And since this is the 5th percentile value, it means that Sam ends up spending above $91,027 in 95 out of 100 cases.

Upside Investing

Full Risk Investing

So far we’ve considered Sam’s a) investing only in safe assets and spending accordingly and b) investing one-fifth of his assets in stocks, letting them ride for 15 years before gradually converting to TIPS/I-Bonds, and, most important, not spending a penny based on money in the market until it’s been converted to safe assets.

MaxiFi Planner also implements Full Risk Investing. (We used to call it Monte Carlo Analysis but changed its name since both Upside Investing and Full Risk Investing feature Monte Carlo simulations.) Full Risk Investing works like this. You specify your current and future asset portfolios and how aggressively you wish to spend through time out of all your resources, risky as well as safe.

You specify your spending behavior via an as-if rate of return. For example, you tell the program you intend to spend, each year, as if you’ll earn, for sure, 2% real on your assets, whatever their current value. The higher you set your as-if rate of return, the more you’ll spend in the short run and the greater will be the potential decline (downside) to your living standard. Let me repeat: Aggressive spending, like aggressive investing, entails more downside living standard risk.

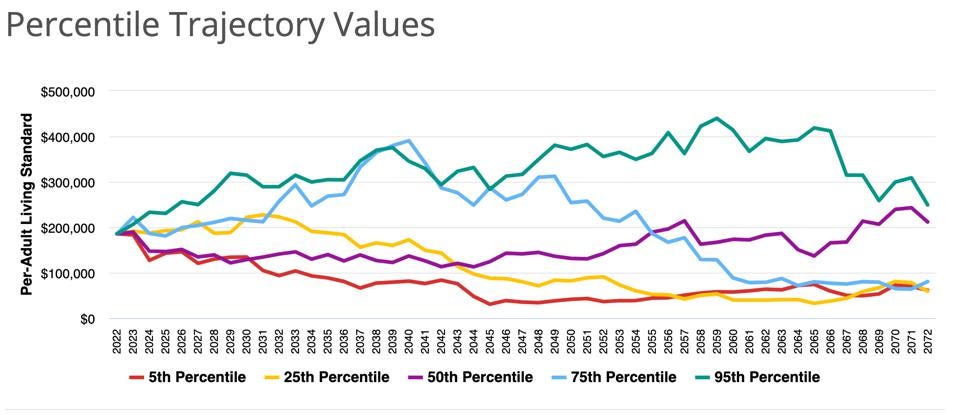

Suppose, for example, that Sam says, “Screw it. I’m going for broke. I’m going to invest all my money in stocks and spend aggressively through time out of whatever I’ve got. Indeed, I’m going to spend as if I’ll always earn 6% real going forward.

The figure below shows Sam’s living standard outcomes. Going for broke rather than investing just 20% or zero in the market certainly produces a much higher upside. The 95th percentile curve generally lies far above that in the above Upside Investing figure. And if Sam ends up on the 5th percentile trajectory? He still gets to spend a lot more over the short term than he would following Upside Investing.

But Sam could hit some very tough times under this particular implementation of Full Risk Investing. For example, Sam’s 5th percentile trajectory spending drops below $40K in some years. And that’s the 5th, not the lowest lifetime spending trajectory. Worse, this particular Monte Carlo simulation shows two out of 500 trajectories in which Sam loses everything — with plenty of years left to starve.

This is a clear example that spending based on Wall Street’s whispered mantra — stocks are safe in the long run and you’ll personally earn the market’s very high average 30-year real return — is hogwash, codswallop, flapdoodle, blether, as well as many words that are far less polite.

Full Risk Investing

(Sam Invests 100 Percent in the Market and Spends Aggressively)

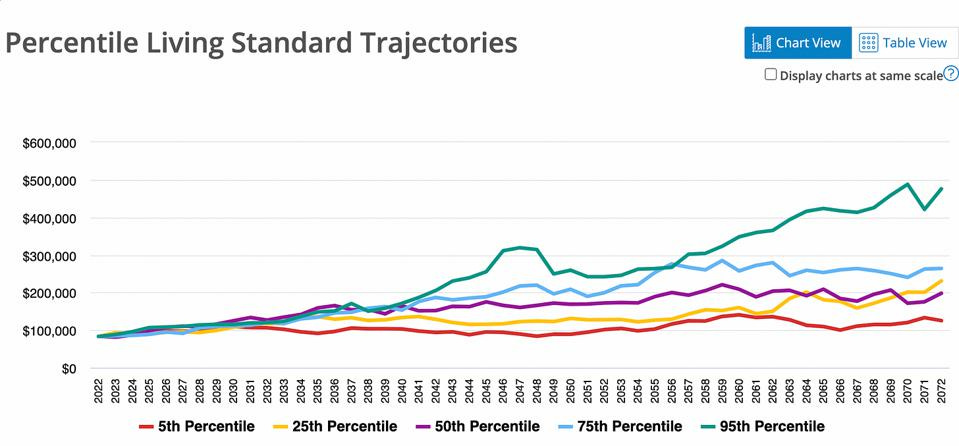

Cautious Full Risk Investing

What if Sam runs full risk investing assuming, for spending purposes, that the market will yield a zero real return and investing 50-50 in stock and bonds. With these inputs, MaxiFi generate no cases in which Sam runs out of money. Instead, Sam’s 5th percentile spending is rarely below Upside Investing’s base living standard. Moreover, by spending more cautiously, Sam increases his upside late in life. By investing less aggressively, Sam narrows the spread of his 5th and 95th percentile trajectories — his living standard cone, as I call it in my new book, Money Magic. And in spending more cautiously, Sam tilts his living standard cone upward.

In short, when you engage in Full Risk Investing, which most people appear to do, you have two levers to limit your living standard downside. One is to invest less aggressively. The other is to spend less aggressively.

Comparing the first and the third figure, you might conclude that Full Risk Investing beats Upside Investing provided Sam invests in a diversified manner and spends very carefully. But MaxiFi’s report shows the minimum annual living standard across all trajectories. For the simulations underlying the third figure, this minimum, which did not arise under the 5th percentile trajectory, is $21,057. That’s miles below Upside Investing’s base living standard floor of $67,125. In short, spending your chickens before they’re hatched always comes with risk.

Full Risk Investing

(Sam Invests 50-50 Stocks and Bonds and Spends Cautiously)

Summary

There are five morals to this story.

You can control your living standard risk — by determining how aggressively to spend as well as invest.

You can see your living standard risk — by running MaxiFi’s Monte Carlo simulations of your living standard outcomes.

Investing only in safe assets — the Safe Assets Only strategy — can eliminate living standard risk (due to investing), but leaves you with no upside potential.

Spending only out of safe assets — Upside Investing — eliminates downside living standard risk, but at a price — spending, for sure in the short run and, possibly, for good, less than under the Safe Assets Only strategy.

Investing in both risky and safe assets and spending annually out of all your assets - Full Risk Investing — entails higher short-term spending and, potentially, a terrific upside, but comes at the risk of tough living standard times and, if you invest and/or spend too aggressively, potential financial ruin.

This Is Not Your Grandfather’s (Wall Street's) Investment Analysis

Sit down with your Certified Financial Planner. Zoom with your Registered Investment Adviser. Meet with your Chartered Financial Analyst. Consult your Certified Fund Specialist. Talk with your Chartered Financial Consultant. Convene with your Chartered Investment Counselor. Engage with your Certified Investment Management Analyst. Facetime with your Chartered Market Technician. Reach out to your Certified Public Accountant. Call any of the mutual fund companies — big or small. Talk to your 401(k) provider. Even check with your know-it-all uncle.

Ask them to show you the distribution of your living standard (annual discretionary spending per household member) trajectories if you invest based on their advice. My guess — they won’t have this in their tool chest … yet!

Laurence Kotlikoff is a Boston University Economist, a NY Times Best Selling Author, President of maxifi.com, and Author of Money Magic.