When Economists Take Leave of the Facts

The NY Times Takes Aim at Bernanke's Capital Glut, Summers' Secular Stagnation, and Blanchard's "Deficits Are Free"

Peter Coy’s recent NY Times column presents a host on inconvenient truths — inconvenient for the factually unsupported, but universally accepted, interconnected views of former Chairman of the Federal Reserve, Ben Bernanke, former Treasury Secretary, Lawrence Summers, and former IMF Chief Economist, Olivier Blanchard.

In 2005, Bernanke claimed, with no real evidence, that there was a global saving glut. In 2013, Summers proclaimed, with no real evidence, that the U.S. was experiencing secular stagnation. And in 2019, Blanchard suggested, based on a misreading of his model as well as reliance on implausible assumptions, that deficits are free.

Coy’s column is entitled, “Older Americans Are Winning the Economic War of the Generations.” It shows the dramatic postwar shift toward the elderly in the age-consumption profile. Coy presented the age-consumption profiles, copied below, for 1960 and 2021. Back in 1960, the average consumption of 40 year-olds was roughly one third higher than that of 70 year olds. In 2021, it was roughly one third lower.

These charts come care of the National Accounts Transfer Project directed by Andrew Mason of the University of Hawaii and Ron Lee of Berkeley. The project has been underway since 2004 — the year before Bernanke proclaimed a global saving glut. It confirmed the massive intergenerational redistribution documented by myself, Berkeley’s Alan Auerbach, and Cato’s Jagadeesh Gokhale — in the U.S. and every country we and our co-authors examined — in numerous generational accounting studies beginning in 1991. That’s 14 years before Bernanke’s proclamation.

My 1996 article (joint with Jagadeesh Gokhale and John Sabelhaus), which appeared in a prominent Brookings Institution journal is entitled, “Understanding the Postwar Decline in U.S. Saving: A Cohort Analysis.” This paper provided the first demonstration of the remarkable postwar tilt in the age-consumption profile toward the elderly. The shift toward higher consumption of the elderly relative to the young has only become more pronounced since 1996.

Our paper appeared nine years before Bernanke’s assertion of a global capital gut. It not only presented a dramatic shifting in the age-consumption profile between 1960 and 1996. It also showed that this critical profile was shifting due to the government’s redistribution from the young to the old — through a gamut of tax and benefit programs and policies.

If the elderly cared about the young, they would simply have redistributed the government’s largess back to their children leaving the age-consumption profile unchanged. But America’s elderly care, with rare exception, about one thing — themselves. And since they are closer to death, they spend, as we showed, roughly three time more out of each dollar of resources than do the young. Hence, taking from the young and giving to the old is taking from savers and giving to spenders. This, as we documented, was why the U.S. saving rate had fallen.

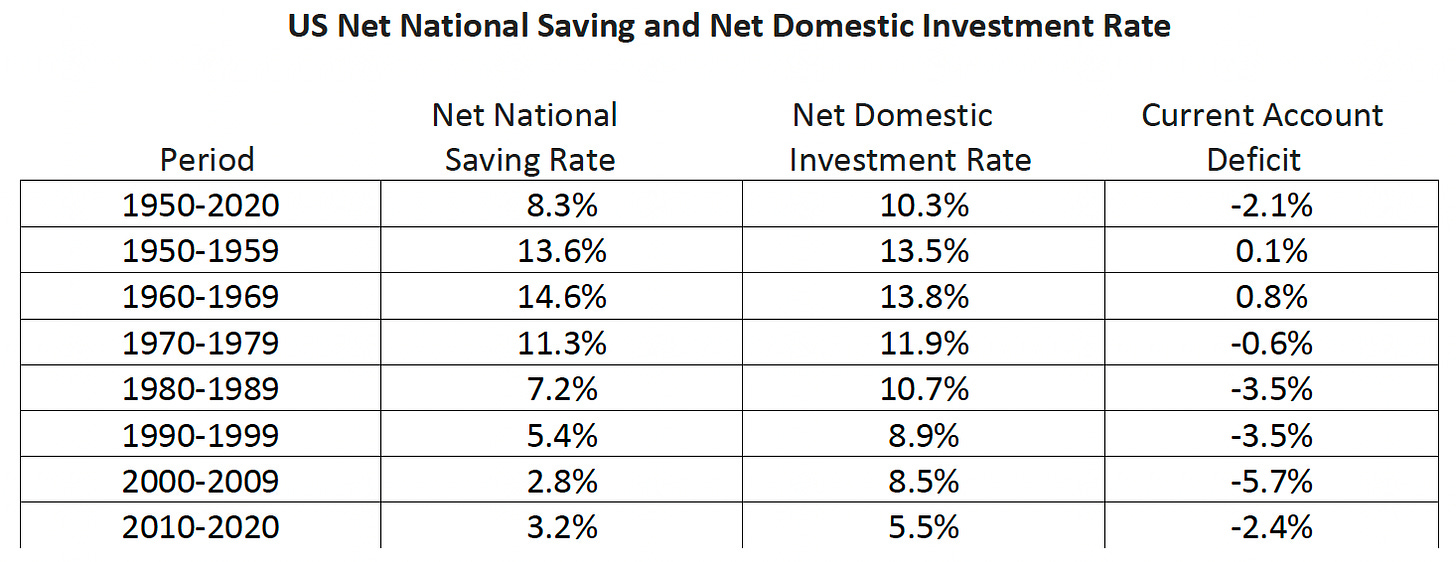

My recent paper with Alan Auerbach, that Coy cites, includes the table below showing the most up-to-date record of postwar rates of U.S. saving, domestic investment, and current-account deficits. Our national saving rate averaged close to 14 percent in the Fifties and Sixties. It averaged 3 percent in the last two decades. This has led to a equally dramatic fall in the rate of domestic investment, which would have fallen even more absent major investment from abroad, measured by the current account deficit.

The postwar decline in national saving rates is a European as well as U.S. phenomenon as documented in this 2008 paper with Loretti Dobrescu and Alberto Motta. Nor is there evidence of any increase in the global net saving rate since 1975, when the World Bank started tracking this rate.

Frankly, I never paid much attention to the so-called global saving gut or the secular stagnation theory that largely relies on the supposed global saving gut. Ok, they hadn’t cited any contradictory studies, including my own, but who cared. All one had to do was look at the clear evidence to the contrary.

Why were Bernanke and Summers propounding theory at such odds with the facts? I had no clue, but figured I wasn’t going to do their homework or, once they had ordained the “truth,” change their minds. And the public wasn’t likely to credit an economist without their credentials.

I also rested assured that my fellow economists understood the facts. Surely, every other economist knew about America’s massive and ever increasing intergenerational Ponzi Scheme. Surely, every other economist knew the elderly were literally eating their children’s lunch. Surely, every other economist knew about the incredible, directly associated, postwar decline in the U.S. saving rate. Surely, every other economist understood European countries were also saving dramatically less. Surely every other economist knew there was no secular increase in America’s capital-output ratio in the Bureau of Economic Analysis data. Surely, every other economist knew there was no global decline in economic growth to support the notion of stagnation, let alone stagnation due to a supposed major drop in capital’s productivity because of its supposed overabundance. And surely, every other economist knew the real return to U.S. wealth between 2010 and 2019 had achieved a postwar high — in complete contradiction to the global capital glut premise.

So, I simply shook my head. But when Blanchard proclaimed in 2019 that more intergenerational redistribution would do no damage, I realized too many economists were drinking the Kool-Aid. Blanchard’s argument is based on the premise that Bernanke’s supposed capital glut had lowered the real return to investment by so much as to make running an even larger intergenerational chain-letter a free lunch.

In his scenario, the U.S. would simply outgrow additional borrowing. Yes, that additional borrowing would mean lower taxes than would otherwise arise and, thus, higher consumption. And yes, the higher consumption would lower national saving and domestic investment. But in Blanchard’s view, the return on that forgone investment was too low to matter. Yes, GDP would be reduced due to less investment, but would still, on net, rise due to population and productivity growth. Would this were even remotely so. Like Bernanke and Summers’ propositions, Blanchard contention was premised on the notion that the pre-COVID decline in government Treasury rates evidenced a major decline in the return to wealth. That leap of faith is, however, very many bridges too far — especially for someone who had written such excellent papers explaining why Treasury rates reflect not just capital’s productivity, but economic risk. And we’re talking global economic risk, at that, since U.S. government bonds are the world’s safest asset and held, in large part, by foreigners.

This paper, by myself and fellow economists Johannes Brumm, Xiangyu Feng, and Felix Kubler, illustrates how easily safe rates can differ from the return to capital. And this paper, with the same co-authors, shows that Blanchard badly misread his own model in delivering his 2019 Presidential Address to the American Economic Association. There is nothing in the data nor in his model to support the former Chief Economist of the International Monetary Fund giving fiscally irresponsible countries, like our own, the green light to further expropriate the next generation and further steepen the age-consumption profile.

Google Global Saving Glut, Secular Stagnation, and Blanchard’s Presidential Address. The number of links goes on for miles. But now that real interest rates are, relative to recent decades, sky high and U.S. economic growth is running at close to 5 percent, Summers, at least, has changed his tune. Apparently, secular stagnation had a very short run. As for Blanchard, he’s still a proponent. I’m not sure where Bernanke’s head is on this these days. But, no matter. The Global Saving Glut, the Secular Stagnation hypothesis, and the Deficits-are-Free views constitute economic cold fusion — a content-free tale of a fiscal free lunch, whose pursuit would simply extend a seven-decade policy of robbing young Peter to feed old Paul.

Pls read You're Hired -- my free downloadable book at kotlikoff.net. Yes, there are actually relatively easy, but politically difficult remedies. best, Larry

I am not sure. looking at the two charts above., I see a couple of things. First, a lot of the increase among older people was in medical care. much of it comes from Medicare and Medicaid which were started in 1965. Further, a lot more people live longer and healthier lives due to more medical care being available and based on better medical science.. 1960 was just at the beginning of modern medicine.

I am 76 and fairly healthy. I take 8 medicines every day which help to control my blood pressure and prevent heart disease. 7 of them did not exist in 1960. My grandfather was close to 70 then and by then he had suffered two heart attacks.

Second, contrary to the allegation that we do not spend on the young, the consumption of educational services has also increased dramatically.

I am not arguing that everything is as good as it can be. And I am very concerned about the fiscal incontinence of the Federal Government. But, I think more people are living longer, better educated, and healthier lives. in 2023 compared to 1960.