Drowning In Student Loans? Consider Refinancing with Uncle Steve, Not Uncle Sam

Family Financial Is a No-Brainer

Student loans total a colossal $1.74 trillion with 43 million Americans owing, on average, $38,000. The loans swamp the $1.14 trillion in outstanding credit card debt, whose average balance is a far smaller $6,864.

Student loans are nasty pieces of work. Today’s student-loan borrowing rate is 6.5 percent. But inflation is running at 2.5 percent. That a 4 percentage point difference — twice the real rate at which Uncle Sam can borrow. Stated differently, our government is borrowing at 2 percent real and lending to students at 4 percent real. There’s a unpleasant, but arguably fitting name for this — usury.

Unlike other loans, you can’t refinance student debt. If you borrow this year at the prevailing 6.5 percent nominal rate, you’ll pay that rate on every penny you owe for as long as you owe it. If inflation falls to zero, your real rate will rise from 4.0 percent to 6.5 percent!

Worse, you can’t discharge student loans in bankruptcy. Uncle Sam can and will hound you to the grave and beyond to recover what you owe. He’ll garnish your tax refund, grab your Social Security check, and even retain your measly Social Security death benefit.

Third, repaying your loan as a 10 percent share of your income, i.e., choosing an income-related repayment plan — the purported way to limit your student-loan repayment burden — can backfire leaving you paying far more over time than had you repaid on a straight-line (standard plan) basis. Fourth, deferring student loans means, to many borrowers surprise, accruing a higher balance. Many student-loan borrowers, some in their sixties and older ties, owe more today than they originally borrowed.

The good news is that three fifths of student debt is owed by those with above-average incomes. The bad news is that student debt represents a half year’s wages or more for millions upon millions of young, middle aged, and older workers, many of whom borrowed to obtain degrees they never completed. It’s no surprise then that a third of those with student loans believe they made a financial mistake borrowing for their education.

Universities and colleges are complicit in taking unsuspecting kids, most of whom have no idea what “compound interest” means, to the cleaners. Indeed, they have the gall to send high school students what they call “award” letters announcing the federal loans they’ve arranged. Putting an unsuspecting child into what may end up as lifetime debtors prison is hardly an “award.”

Measuring the Student Loan Problem in Tears

My book, Money Magic, has a chapter on student loans. It’s title, DON’T BORROW FOR COLLEGE, holds no bar, especially for a college professor. The more this college professor looks at student loans, the more his stomach turns.

The book’s chapter starts with an awful mistake I made twelve years back. I was teaching a course on economics-based financial planning. The lecture that day was on student debt. I spent a half hour explaining its perils. Then I asked the class to raise their hands if they had borrowed for college.

Almost all hands shot up. Next I said, “Keep your hand up if you owe more than $25,000.” Half the hands came down. Next, I moved to $50,000 , then $75,000, and, finally, $100,000. One hand remained airborne.

I was concerned, but I figured the student was a business or software major who’d have no problem repaying. To confirm my hunch, I proceeded to place my right foot fully in my mouth. I asked the student, I’ll call her Susan, her class and major.

Susan said she was a senior majoring in Art History with $120,000 in outstanding loans, federal and private. Note, $120K in 2012 is roughly $170K today.

OMG, I thought. “Susan has bleebed herself. But maybe there’s a silver lining? Maybe Susan has landed a high-paying job at Christie’s or Sotheby’s?”

In went the left foot. I asked Susan if she had lined up a job to start after graduation — only two months away.

“No! I sent out hundreds of applications in December and January, most for unpaid internships.”

“Have you heard back?”

“Twelve internships sent back letters saying ‘I’m sorry’. That’s it.”

Then she started to cry.

At that point, Dawn rose on Marble Head. Marble Head is a small coastal village north of Boston. The sun rises early there thanks to its easterly location. The expression is a polite way of telling someone they’re a moron. I whispered this to myself as I apologized profusely. Fortunately, I didn’t blurt out what came next to mind.

Susan had borrowed so much to pursue her dream career to rule out her dream career.

Lowering the Burden of Your Student Loans

Let me suggest how those with student loans might ease their burdens. I’ll do so by way of a hypothetical case study involving Beth, a single, 35 year-old, Bostonian. Beth makes $55,000 a year and expects her salary to keep even with inflation. She lives in an apartment with three roommates, so spends only $1,500 a month on rent. Beth has $150K in her retirement account and $25K in her checking account. She plans to retire at 65 and take Social Security starting then.

Beth owes $80,000 in student debt, which she borrowed at 6.5 percent and is repaying over 30 years. Specifically, Beth will be forking over $6317 to Uncle Sam, year in and year out, through 2054. The $6317 is a nominal payment. Hence, based on current projection, Beth’s real payment 30 years from now will be half this year’s amount. That’s nice, but $80K is still two years of take-home pay.

Given her current and future federal and Mass taxes, Medicare Part B premiums, housing costs, and debt repayment, Beth can afford to spend $19,711 in today’s dollars through age 100, which is her maximum age of life. Her fixed costs (non-discretionary spending) this year totals $36,951 — twice her discretionary spending. It comprises $18,000 for housing, $1,650 in 401(k) contributions, $4,553 in federal incomes taxes, $2,223 in state income taxes, $4,208 in FICA taxes, and the $6,317 loan repayment. Hence, this year’s student loan repayment is 32.0 percent of her $19,711 level of discretionary spending!

These and other calculations below were, by the way, made with my company’s economics-based financial planning software, MaxiFi Planner. For $109 (the annual license), Beth can make these calcs herself.

Repaying in Ten, Not Thirty Years

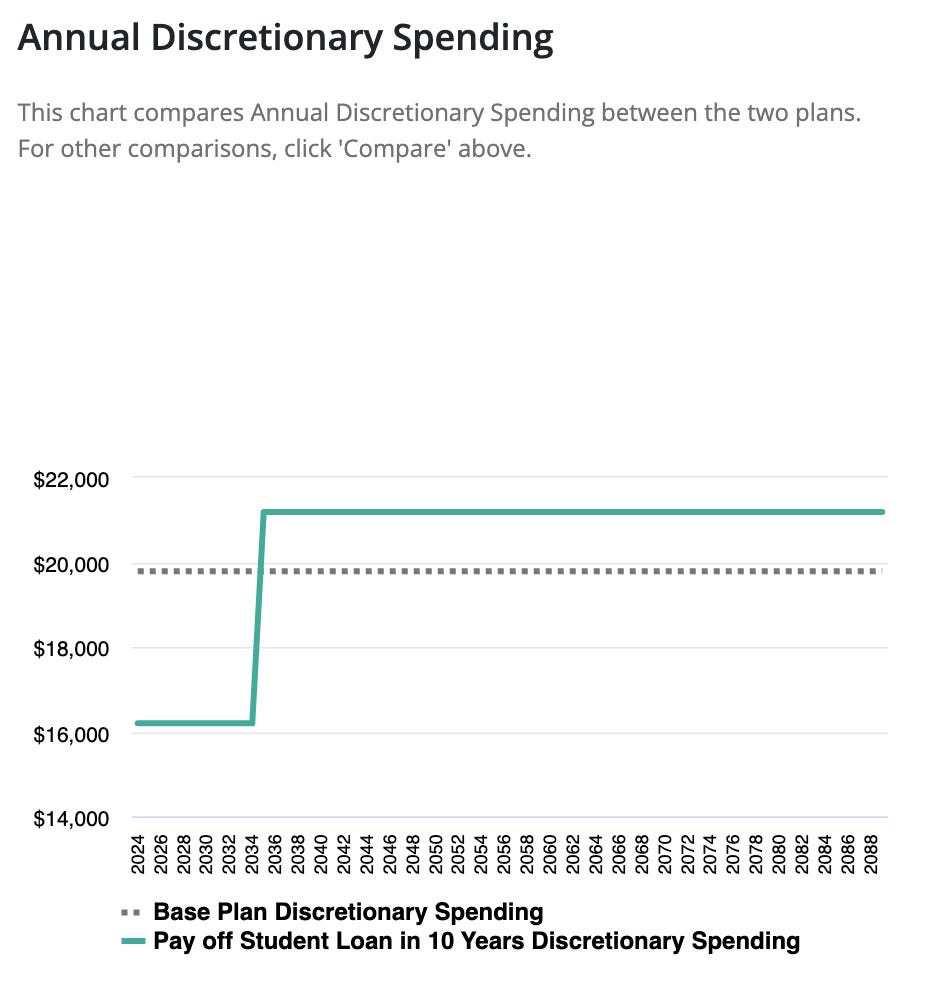

What if Beth repays over ten years? Doing so raises her annual nominal payment to $11,128. Since Beth’s loans bear a 6.5 percent interest rate and she can earn only 4.5 percent on her savings, paying her student loan off 20 years early lowers her lifetime repayment cost — by $6,731 to be precise. But as the discretionary spending figure below shows (the dotted and green curves reference, respectively, the 30-year and 10-year payoff scenarios), Beth is cashflow constrained. Hence, the only way she can repay her loan in ten years is to dramatically cut her spending.

The story’s actually worse. Beth’s forced spending reduction represents a form of forced saving. Hence, she ends up in retirement with higher assets. How so? After year 10, Beth saves out of the money she’d otherwise be allocating to loan repayments. This higher saving lets Beth maintain her living standard at a permanently higher level. But here’s the rub. The additional old-age assets produce additional old-age taxable income and, thus, higher taxes. Surprisingly, those higher taxes, both federal and state, are almost as large as the $6,731 Beth gains from prepaying her loan. On balance, prepayment adds only $671 in present value to Beth’s lifetime discretionary spending. The small gain combined with the huge required short-term spending cut makes early repayment a clear loser.

Uncle Steve to the Rescue

As mentioned, Beth can’t hope to refinance with Uncle Sam. But how about Uncle Steve? He’s currently holding several hundred thousand in 30-year Treasuries yielding 4.5 percent. What if he sells $80K worth and lends the money to his favorite niece. Beth’s trustworthy and her job’s secure. If Steve lends $80K to Beth at 4.5 percent, Beth’s annual payments drop from $6,317 to $4,911. This is a winner. It raises Beth’s lifetime spending by $17,730 permitting her to spend almost $500 more per year.

That’s close to a 3 percent real increase. It’s something, but not great guns. But there may be other deals that Beth and Uncle Steve could cut. One is asking Uncle Steve to pay off the entire loan now in exchange her giving Steve’s son, Joey, a 20 percent share of the $1 million house Beth will inherit when her parents pass. That’s risky since her parents may need to sell the home to cover end of life nursing home costs. But Steve cuts the deal, making them both better off. In particular, Beth’s living standard rises by 13 percent or $2,490 a year.

More Money Magic

Beth, it turns out, has the option to work remotely. What if she leaves her rat-infested neighborhood of Brighton, MA and moves to Salem, New Hampshire. For $1,500 a month she can get a much better place. And, get this, New Hampshire has no state income tax. The move saves Beth over $55K in state income taxes, measured in present value, permitting her to spend 20 percent more, $4,016 annually, than in the base plan.

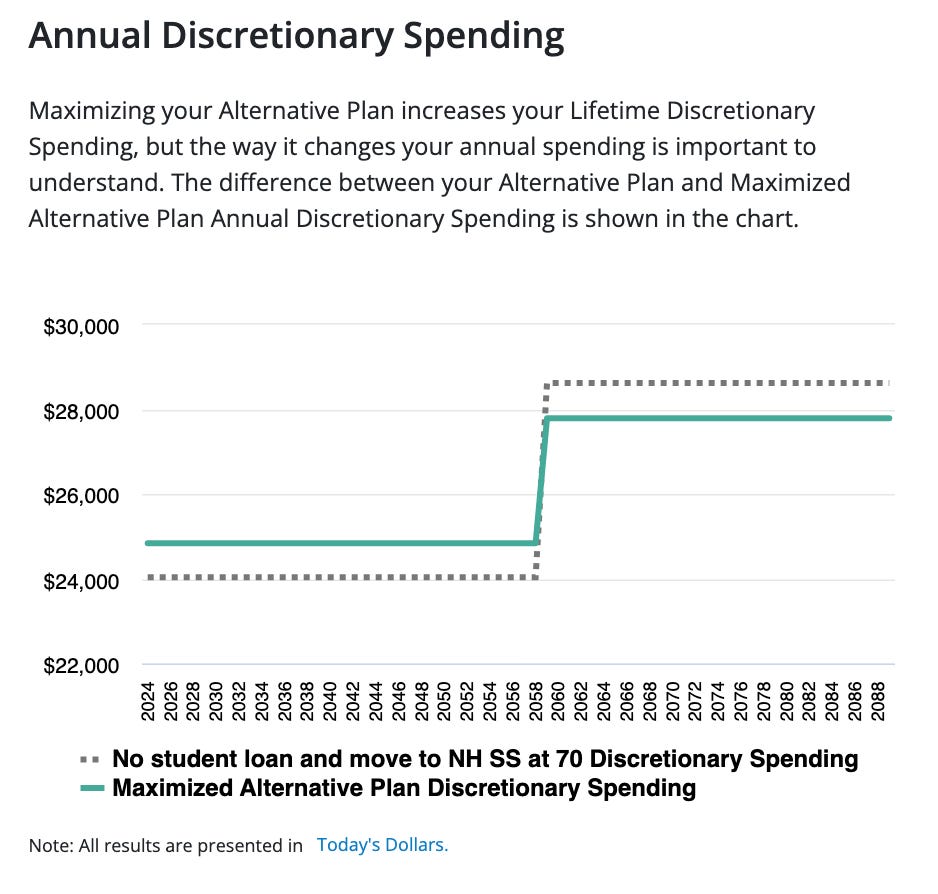

Next, suppose Beth cuts the deal with Uncle Steve, moves to New Hampshire, but also chooses to wait till age 70 to collect her Social Security. Compared to the base plan, Beth’s lifetime spending is $202,096 higher, letting her spend $4,247 more each year before age 70 and $8,828 more thereafter. These represent a 21 percent living standard rise through age 70 and a 45 percent increase thereafter!

Finally, I let MaxiFi robo-maximize the previous profile (see chart below) over two dimensions — when Beth should start her retirement account withdrawals and how much to Roth convert annually. This produced an additional present value lifetime spending gain by lowering Beth’s lifetime taxes. The gain, though, is small, just $10,989. Achieving this tax reductions does, however, entail significant changes in behavior. Beth now starts smoothly withdrawing from her 401(k) at age 59 rather than age 65. She also Roth converts $93,629 starting in the current year and continuing through age 50. The chart below shows Beth’s additional discretionary spending gains arising from MaxiFi’s reduction in her lifetime taxes.

As you’ve seen, Beth can make money magic by engaging in some high finance with Uncle Steve. But she can make even more magic by lowering her lifetime state and federal taxes and raising her lifetime Social Security benefits.

Closing Thoughs — The Right Student Loan Policy

The real student loan solution lies, of course, with the federal government. To his great credit, President Biden has tried repeatedly to provide student debt relief. But his method — declaring that specific loans don’t need to be repaid or repaid in full — hasn’t sat well with the courts. Indeed, his “help” may, on balance, have made things worse. Many borrowers may have stopped repaying or repaid less because they thought their loans were terminated or reduced. Others may have held off or be holding off making payments in hopes that particular court decisions will be reversed. Deferring loan payments is nuts. It leads the outstanding balance to grow at a compound rate.

To me the obvious answer is to let students, including those in the trades, borrow at the government’s 30-year Treasury bond rate with the option to refinance whenever rates fall. There would be far fewer defaults. And even if Uncle Sam loses money on average, the value of having a better educated and more highly skilled society is worth it. We learn from each other. And when we know more, we can do more. Hence, education produces external benefits. Indeed, education is arguably economics’ most powerful positive externality. It’s also a gift that keeps on giving. Parents educate their kids who educate their kids who educate …

Today’s MaxiFi Testimonial

“I’m a recently retired physician and I find Maxifi Planner one of the most comforting tools available. It provides me the reassurance that my wife and I will have a comfortable retirement and we can afford to enjoy our future. Most financial plans are static documents that quickly become obsolete. Maxifi is dynamic and puts the power of financial planning into my hands which helps me sleep soundly and comfortably. Thank you, Prof Kotlikoff and staff.”

Steven B. Levine, MD Connecticut

Yes, amazing and depressing. best, Larry

Hi Charles, With you. I discussed this option in the book. Ten years is a long time to work at a potentially lower wage than you could otherwise earn. And the lagged in forgiveness is despicable. My best, Larry